A look at the funding scenario for startups in India in the first half of calendar year 2023

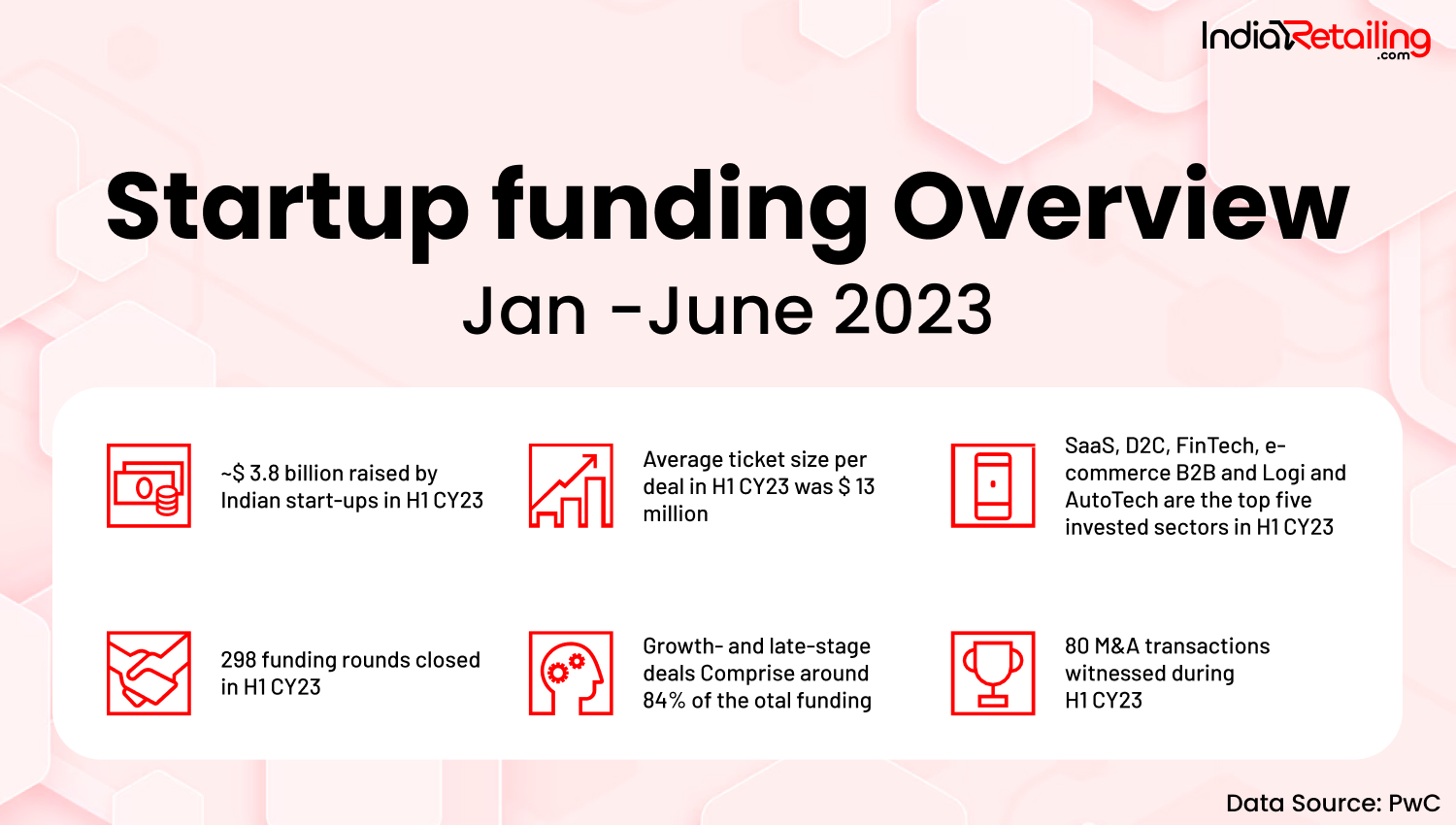

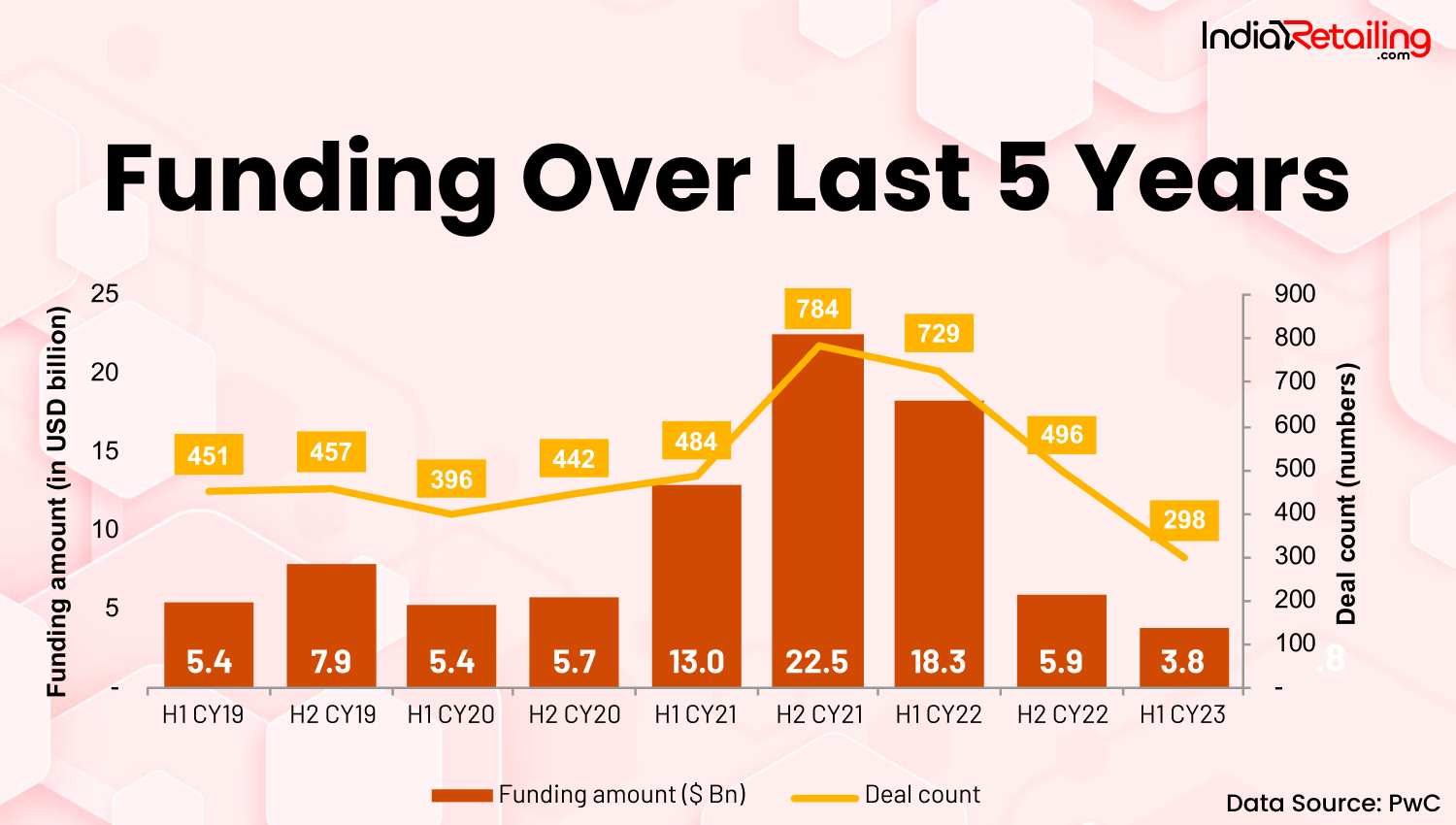

Mumbai: Funding in the Indian startup ecosystem continues with cautious optimism. Despite the significant dry powder earmarked for Indian start-ups, the ecosystem reported the lowest six-month funding trends in the last four years during first half of calendar year 2023 (H1CY23) at $ 3.8 billion across 298 deals, as per India Start-up Deals Tracker H1 CY23 – A Report by PwC. Start-ups have demonstrated resourcefulness in the current environment in order to increase their funding runway by cutting down on discretionary expenses and tapping into capital from internal rounds as well as alternate financing options, like venture debt.

During the last few quarters, investors have supported their portfolio companies by doubling their investments into companies that are showing good growth but have decided to stay away from inducting new investors due to adverse market conditions. However, there has been an increase in the due diligence being carried out by investors before making investments, both in terms of detailing and coverage (from typical finance and legal, to now covering technology, HR and business processes).

These are driven by the recent financial misreporting issues that have come to light, and the market conditions when investors are able to perform thorough due diligence to differentiate between start-ups and make more informed investment decisions. At present, apart from addressing governance matters, we find that founders, top management and investors are coming together to proactively implement environmental, social and governance (ESG) principles into the start-ups’ core operations. In addition to fulfilling a moral responsibility towards society, the right ESG framework helps attract investors, customers and talent (do read the prior edition for our point of view on ESG for start-ups).

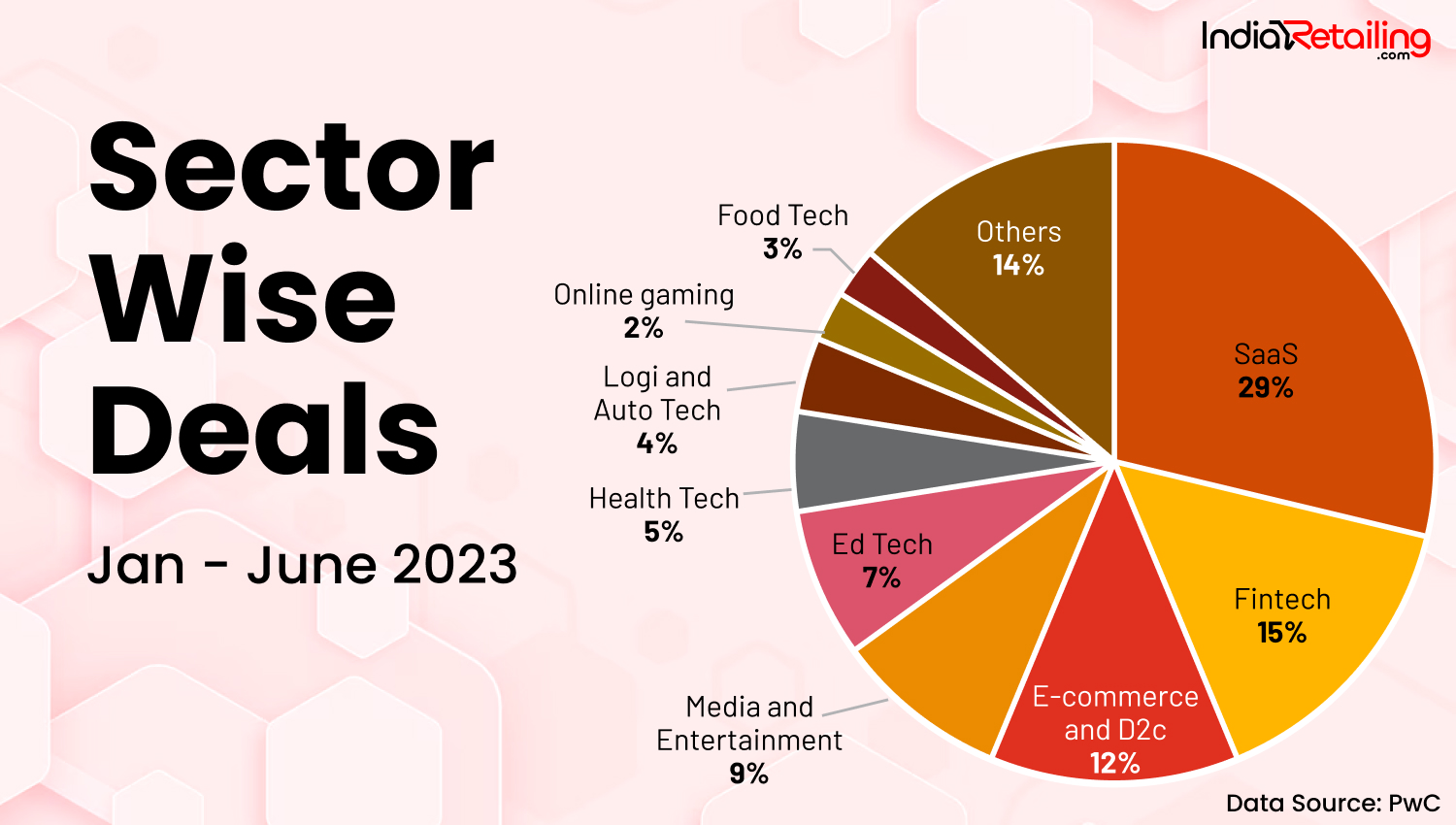

$ 3.8 billion raised by Indian start-ups in H1 CY23 – SaaS, D2C and FinTech continue to be the top invested sectors during H1 CY23.

A Snapshot

There was a decline in the total funds raised in H1 CY23 ($ 3.8 billion) by nearly 36% as compared to H2 CY22 ($ 5.9billion). This decline was noted both in value as well as volume terms.

A total of 298 deals were closed during H1 CY23 across stages – early stage (171), growth-stage (104) and late-stage (23) The average deal ticket size ranged from $ 12 to 13 million during H1 CY23.

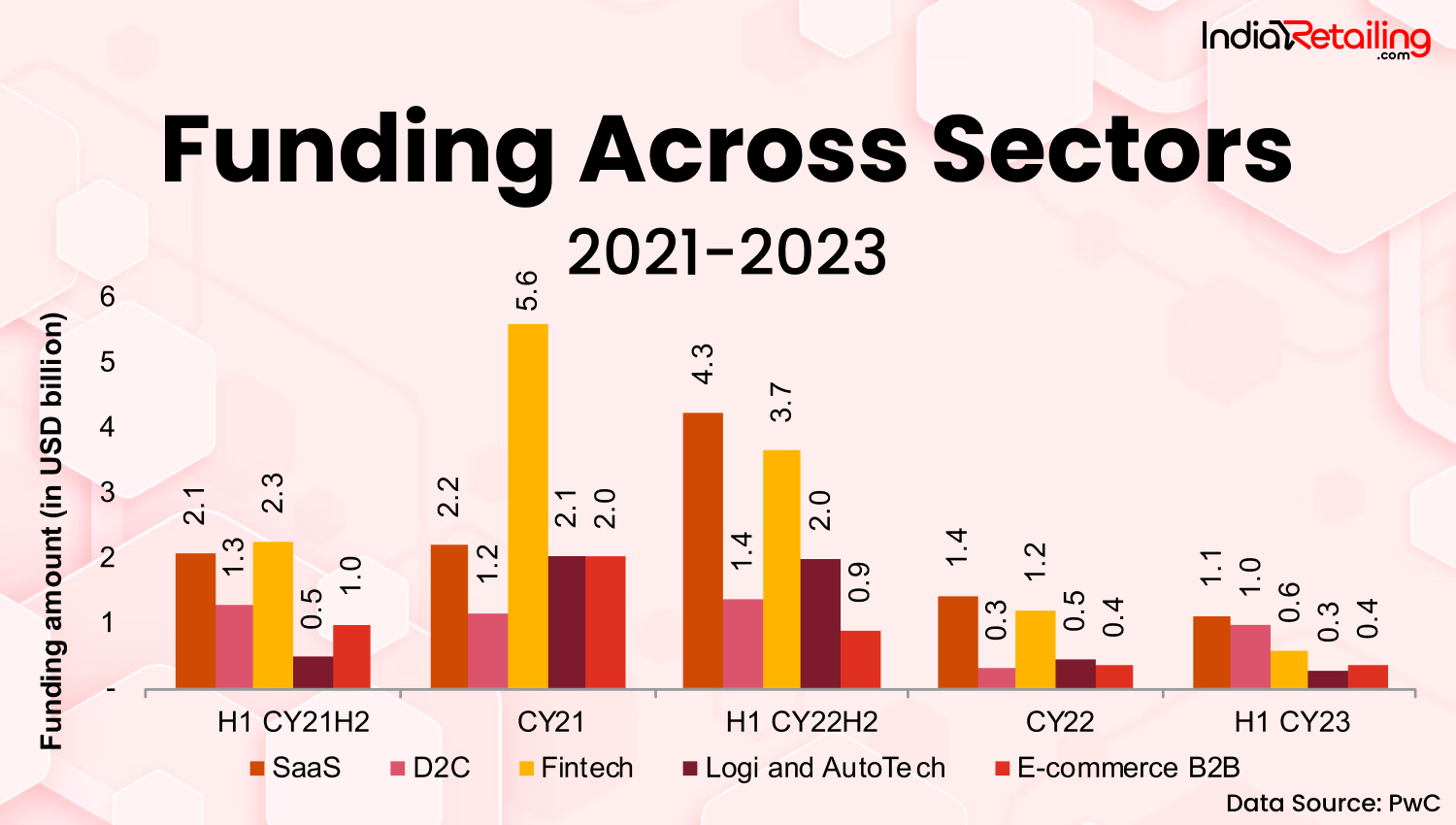

SaaS, D2C, FinTech, e-commerce B2B and Logi and Auto Tech continue to be the top five invested sectors based on the funding received in the first half of the year. These contribute to approximately 89 per cent of the total funding received in H1 CY23 in value terms.

There were eight significant fundings which were noted in H1 CY23 that raised more than $ 100 million. These were across D2C, SaaS, FinTech and e-commerce – LensKart and FreshtoHome (D2C), Builder.ai (SaaS), InsuranceDekho, KrediBee and Minitifi (FinTech) and Zetwerk and Infra.Market ( e-commerce B2B).

Early-stage deals accounted for 57% of the total funding in H1 CY23 (in volume terms). The average ticket size per deal was $ 4 million. In value terms, early-stage deals contributed to approximately 16% of the total funding in H1 CY23. Early-stage funding activity was at its lowest in H1 CY23 as compared to the previous two years.

Growth- and late-stage funding deals accounted for 84% of the funding activity in H1 CY23 (in value terms). These represented 43% of the total count of deals in this period. The average ticket size in growth-stage deals was $ 19 million and late-stage deals was $ 52 million during H1 CY23.

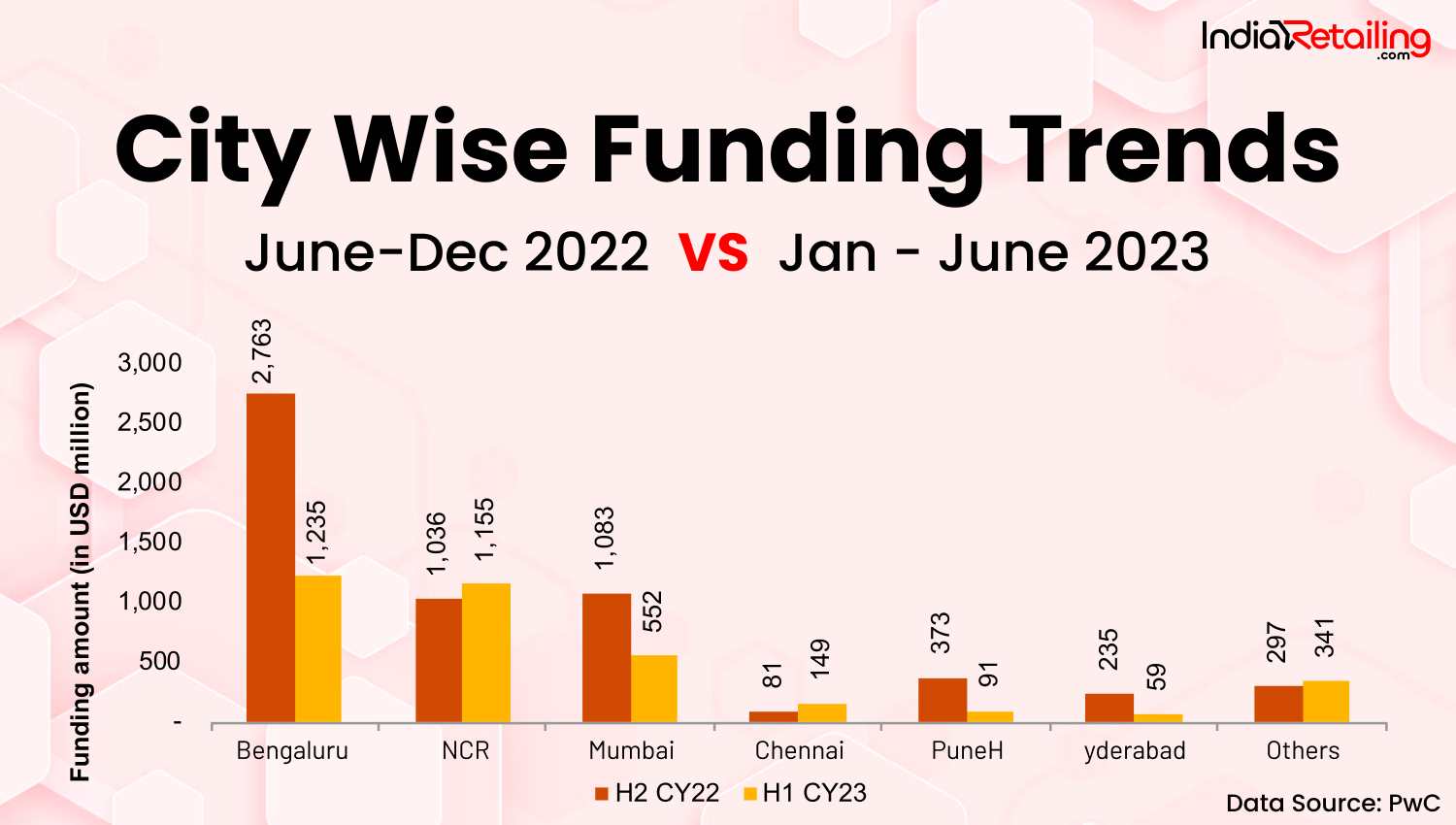

Talking about city-wise funding, Bengaluru, NCR and Mumbai continue to be the key startup cities in India, representing around 83% of the total startup funding activity in H1 CY23. Decline in funding activity was noted across all cities in H1 CY23 barring Chennai, which witnessed higher funding in the SaaS space.

Bengaluru: More than $ 50 million was raised by six companies each in H1 CY23. These include Zetwerk, KreditBee, FreshToHome, Agilitas Sports, Ushur and Acceldata

NCR: Three companies which include Lenskart, Builder.ai and Safe Security have raised more than $ 50 million each in H1 CY23.

Mumbai: More than $ 50 million was raised by four companies each in H1 23. These include Infra.Market, Mintifi, Purplle and Course5 Intelligence.

In terms of deal volume, M&A deals remained constant during H1 CY23 compared to H2 CY22, with nearly 56% of the transactions being contributed by the top three sectors – SaaS, FinTech, and e-commerce and D2C.

Similar to the VC funding activity, SaaS (23), FinTech (11) and e-commerce and D2C (10) continue to witness the highest number of M&A transactions during H1 CY23. • H1 CY23 witnessed 64 domestic, six inbound and ten outbound deals.

Bengaluru, NCR and Mumbai continue to be the top cities for M&A transactions, followed by Hyderabad during H1 CY23. These four cities contributed to 75% of the M&A deals during H1 CY23.

Key Insights – Sector wise Funding

SaaS contributed to 30% of the total funding activity during H1 CY23, witnessing a decrease in the funding activity by 21% compared to H2 CY22. Average ticket size of deal ranged from ~$ 10 to 11 million during H1 CY23. Builder.ai raised more than $ 100 million during H1 CY23, which represented 22% of funding activity in this sector during H1 CY23.

D2C: During the first half of CY23, there has been a significant increase in the funding activity, amounting to almost three times that of H2 CY22. This sector witnessed more number of deals in the growth- and late-stage deals in H1 CY23 compared to H2 CY22, which was driven by funding in early-stage rounds. The average ticket sizes of deals also increased from $ 8 million in H2 CY22 to $ 43 million in H1 CY23. Lenskart and FreshToHome has raised more than $ 100 million during H1 CY23 contributing to 72% of the deal funding received in this sector.

FinTech sector witnessed a decline in the funding value raised during H1 CY23 by 50% compared to H2 CY22. Approximately 62% of the deals (in terms of deal count) in this space were driven by early-stage funding rounds, with an average ticket size of $ 5 million in H1 CY23. About 64% of the funding received by this sector was driven by InsuranceDekho, KreditBee and Mintifi which have raised more than $ 100 million during H1 CY23.

E-commerce B2B: This sector witnessed a decline in funding activity by 6% compared to H2 CY22. The funding received during H1 CY23 were driven by Zetwerk and Infra.Market which contributed to 84% of the total funding received by this space during H1 CY23.

Logi and AutoTech: Approximately 63% of the deals (in terms of deal count) in this space were driven by early-stage funding rounds, with an average ticket size of $ 6 million in H1 CY23.

HealthTech: There was a decrease in the funding activity during H1 CY23 by 77% compared to H2 CY22. The average ticket size of deals in this space decreased from $ 9 million in H2 CY22 to $ 4 million; majorly, early-stage deals in this sector were noted during H1 CY23.

EdTech: Approximately 60% of the deals (in terms of deal count) in this space were driven by growth-stage funding rounds, with an average ticket size of $ 10 million in H1 CY23. Bjyus and UpGrad raised significant funds, amounting to more than $ 200 million each in H2 CY22.

Online Gaming: An increase in the funding activity in terms of value was witnessed, with a three times increase in H1 CY23 compared to H2 CY22 in funding value. The funding activities in this sector are driven mostly by early-stage funding rounds which contribute to 73% of the total funding raised by this sector during H1 CY23. Key companies which raised funds include Mayhem Studios and Rooter.

FoodTech: The funding in this sector increased by four times in H1 CY23 compared to H2 CY22 in value terms. The average ticket size of the deals in this space has increased from $ 1 million in H2 CY22 to $ 9 million in H1 CY23. Curefoods raised $ 37 million during H1 CY23.

Amit Nawka, Partner – Deals & India Startups Leader, PwC India, said, “A funding winter is just a season in a startup’s journey. There is a slowdown in startup funding despite significant untapped capital reserves held by venture capitalists (VCs). Active VC firms in India have secured new funds in the past year and we can expect the pace of investments to pick up in the next few months. In the interim, there has been an increase in the due diligence being carried out by investors before making investments, both in terms of detailing as well as coverage – from typical finance and legal, to areas like technology, HR and business processes – to ensure that the startups have a robust corporate governance framework.”

This article first appeared in IMAGES Group’s Images Retail Magazine September 2023 edition