The apparel market size in India in 2016 was estimated to be Rs 2,90,000 crore which is expected to grow at a CAGR of 9.7 per cent to reach Rs 4,66,000 crore and Rs 7,48,000 crore by 2021 and 2026 respectively. Of the total apparel market in 2015, men’s wear accounted for 41 per cent, women’s wear accounted for 38 per cent and kidswear accounted for 21 per cent.

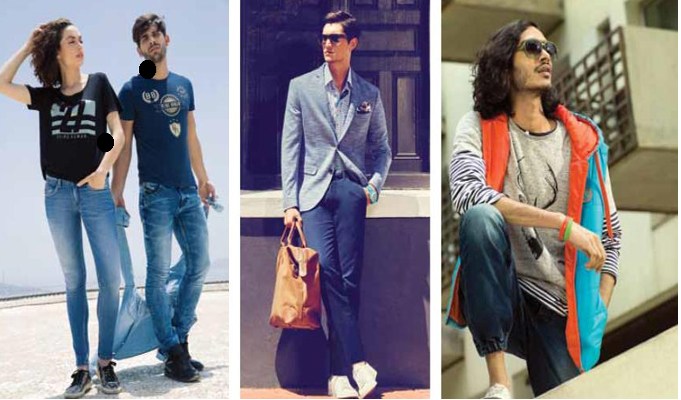

Casual Wear Rising

Within the overall apparel market, the Indian casual wear market has evolved significantly over the last couple of years. The industry has witnessed rapid growth, triggered by increasing usage of casual wear by fashion conscious employees of major MNC’s due to the relaxation of dress codes. The change in work culture is offering immense potential for the manufacturers of casual wear. These brands are growing across all segments of the Indian market (premium, medium and value for money). International brands like Tommy Hilfiger and Espirit have seen steady growth over the years in their casual wear segment. Other brands such as Calvin Klein and Guess are increasing their footprints in this segment. Even premium brands such as Mango, Zara and Arrow have introduced casual wear at the entry level to attract first time consumers.

The Way Ahead for Casual Wear

The Indian casual wear market is booming and the rural markets will play a pivotal role in this growth story. Factors including a growing middle class population, rising disposable income, increasing brand awareness among the consumers in terms of quality and up-gradation of service standards, rapid shift from tailored to ready-to-wear suits, the growing service sector ensure promising future for casual wear segment. There is a huge scope for product innovation within the casual wear segment. India has become a market with a plethora of opportunities and brands and retailers who understand the needs of Indian customers better are expected to leverage the opportunities to derive growth.

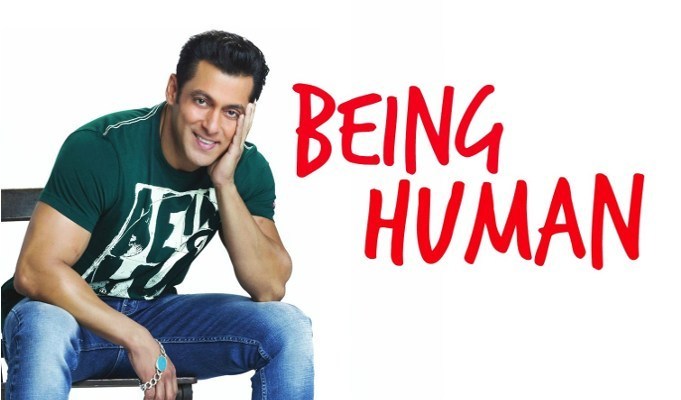

1. BEING HUMAN

Being Human, a clothing line with a heart, was launched by Salman Khan in 2012. Globally licensed to Mandhana Retail Ventures Ltd., it has has more than 600 point-of-sale globally. Royalties from merchandise sale give impetus to the initiatives of Being Human-The Salman Khan Foundation in India, dedicated to the twin causes of education and healthcare for the underprivileged. This unique business model finds an instant international connect, acceptance and appreciation. The ability to look good and do good at the same time empowers consumers globally and wins their hearts. It is retailed across multiple channels including exclusive stores, shop-in-shops, distributor networks and e-commerce websites internationally and in India. With its trend-setting international design, impeccable quality and customer friendly retail environment, the brand is truly global in spirit and offers top-notch apparel and accessories for both men and women.

USP and Target Consumer

The brand’s USP is celebrity, charity and fashion. The customer base consists of people who believe in international fashion and follow the latest trends, however they believe in doing good too by helping the brand’s charity initiatives of healthcare and education. Hence they ‘Look Good and Do Good’.

Retail Mapping

Area wise, the brand enjoys strong demand in North, West and East. The brand has also registered a rising response from Tier-II and -III cities. Being Human’s online partners include Myntra, Jabong, etc. The brand is also present internationally in Mauritius, Nepal, France and the Middle East.

2. GAP

GAP, one of the world’s most iconic apparel and accessories brands, was founded in San Francisco in 1969. Beginning with the first international store in London in 1987, GAP continues to connect with customers online and across the brand’s about 1,700 company-operated and franchise retail locations around the world. GAP includes women’s and men’s apparel and accessories, GAPKids, babyGAP, GAPMaternity, GAPBody and GAPFit collections. GAP was launched in India in May 2015.

Target Consumer

GAP is the authority on classic American style and presents a line of denim and classic casual apparel and accessories for men, women, kids and babies. The GAP consumer is SEC A+, A and B+, ranging in the ages of 0-40.

Retail Mapping

GAP retails online through Amazon. in and GAP.nnnow.com. It is present in metros and Tier-I markets through physical stores. Of late, the brand also has launched stores in Tier -II cities.

Domestic Retail Expansion Plans

GAP plans to continue expanding into Tier-I and -II markets, along with offering the brand’s reach to 1,000s of postcodes.

3. JACK & JONES

Started in 1990, Jack & Jones is a democratic jeans brand that helps fashion conscious men create their own personal style. Today, Jack & Jones is one of the Europe’s leading producers of men’s wear with more than 1,000 stores in 38 countries with products being sold by thousands of wholesale partners all over the world. In India, Jack & Jones was introduced in the year 2008. The brand continues to have a high level of expertise when it comes to the craftsmanship, quality and design of jeans. Over the past few years, Jack & Jones, through its marketing activities, has built a perception of being a disruptive, rebellious and an edgy brand.

Target Consumer

The brand targets men who want to flaunt their individual style statement.

Retail Mapping

Available at leading online partners along with own website for e-commerce, EBOs and shop-in-shops Jack & Jones is present in 38 countries globally.

Domestic Retail Expansion Plans

Jack & Jones continues to look forward to explore opportunities in new markets, especially in Tier-II and -III cities.

Technology Deployment

Technology is positively contributing to almost all functions of the retail business like operations, supply chain management, marketing, customer accessibility, etc. E-commerce has allowed the brand to reach the consumers in places where physical stores are not feasible. Jack & Jones is currently working on its Omnichannel strategy.

4. LACOSTE

In 1933, René Lacoste, a French tennis legend and André Gillier, the owner and President of the largest French knitwear manufacturing firm of that time, set up a company to manufacture the prominent logo-embroidered shirt. The champion had originally designed this for his own use on the tennis court, golf and sailing. This was the first time that a brand name appeared on the outside of an article of clothing – an idea which has since become extremely successful. This shirt revolutionized men’s sportswear and soon replaced the woven fabric, long-sleeved, starched classic shirts. Today, it continues to offer the same quality, comfort and solidity on which it built its name. Lacoste believes in providing a superlative experience to its customers and hence is very selective about the retail areas. In India, the brand has one or two flagship boutiques in each of the key cities, i.e., Delhi, Mumbai, Bengaluru, Chennai, Kolkata, Hyderabad, Chandigarh and Pune, with approx. 1,200-1,500 sq.ft. boutiques in other key retail developments.

Target Consumer

Lacoste caters to men and women who possess an active life-style and desire comfortable, affordable yet qualitative, timeless products to accompany them in the different moments of their daily lives. Lacoste products assist these individuals in expressing their lifestyle that encompasses elegance, refinement, comfort and quality to the outer world.

Retail Mapping

Lacoste has selective distribution policy which is essential to keep the exclusive positioning of the brand. The distribution strategy is led by one or two flagship stores in each of the key cities, i.e., Delhi, Mumbai, Bengaluru, Chennai, Kolkata, Hyderabad, Chandigarh and Pune in India, with approx. 1,200-1,500 sq.ft. boutiques in other key retail developments. The brand also has a digital flagship store (online store) in India. Lacoste is present in international markets across 120 countries wherein 2 Lacoste products are sold every second. In India, the brand sells one product every 2 minutes.

Domestic Retail Expansion Plans

Delhi and Mumbai being the most important markets, the brand has much deeper penetration in these markets and intends to expand further. It is keenly watching the premium developments in Tier-I and Tier-II cities, both in terms of consumer demographics and psychographics, and also in relevant retail developments. The brand is open to exploring store opening at any location in India where like-minded brands are present and quality infrastructure is available.

Technology Deployment

Technology has played a phenomenal role in the fashion industry for both the customers as well as sellers. With the emergence of the online podium, the industry has provided a convenient shopping and less time-consuming experience to the customers. Data availability and analysis ensure understanding of customers’ buying patterns and future forecast is relatively better planned. The age-old principles of good quality product, great customer service assisted by new technological tools provide a perfect blend to bring a smile to customers’ and sellers’ face.

Omnichannel Presence

Besides retail boutiques, the brand also has its digital flagship store (online store) in India which has certainly aided the sales in the country while offering convenience to our patrons.

5. LEE COOPER

Lee Cooper is an authentic British denim brand which has been catering to the youth and their celebrity icons since 1908. Creating specialised cuts and innovative new styles has always been at the core of the brand. Innovation, originality, style, attitude and comfort have been the ideologies that have always been at the core, resulting in the creation of jeans such as flexible denim, water resistant denim and reverso jeans. Lee Cooper entered India through a licensee agreement with Future Lifestyle Fashion Ltd. In 2007. Today, the brand is retailed out of more than 6,000 outlets worldwide in nearly 100 countries.

USP and Target Consumer

In India, the USP of the brand lies in the fact that apart from having a very strong foothold in men’s category, its women’s line has got a very exciting response, being by far the best accepted brand in key premium retail chains like Central. Lee Cooper’s kids range is also doing exceptionally well across chains like Lifestyle and Central.

Lee Cooper considers the young and youthful, who exuberate attitude and confidence at all times as its core target consumer. Looking cool without trying too hard is the mindset that the brand’s customers live with and hence being on-trend is what matters the most to them.

Retail Mapping

Lee Cooper has a global presence in more than 100 countries. In India, the brand is present in more than 150 cities including primary markets like Mumbai, Bengaluru, Kolkata, Hyderabad, Pune, Delhi and Chennai. Lee Cooper retails through large format stores including Central, Lifestyle, Reliance, etc. with majority of business coming from department stores. The brand has SIS presence of more than 1,200 doors. The brand is also planning to expand in Tier-II and -III towns in times to come. Lee Cooper also retails through major e-commerce websites like Jabong, Myntra, Amazon and Flipkart.

Domestic Retail Expansion Plans

Lee Cooper boasts of an extensive presence across India and the brand’s key focus is to drive organic growth, that is, growth from existing doors with penetration of newer lines and sharper product offerings across categories in men’s, women’s and kids’ segments. In terms of inorganic growth, the brand is planning to add around 500 doors spread across LFS and EBO channels within the next 2-3 years.

Share of Casual Wear in Total Revenue

Around 40 percent of the total business of the brand comes from its casual wear range.

6. VERO MODA

A brand known for its classic styling, premium fabrics, trendy collections and offering runway styles at affordable prices, Vero Moda was launched in 1987 and soon became one of Europe’s largest women’s wear clothing brands. Vero Moda’s healthy and successful start provided a solid foundation for the continuing expansion and success of the brand. The brand entered India in 2010 and ever since, it has been recognized as one of the most admired women’s western wear fashion brands consecutively for four years in India. Apart from this, the brand has won numerous accolades in digital marketing and integrated marketing campaigns.

Target Consumer and USP

The Vero Moda woman is the one who uses fashion as a tool to sharply demonstrate her personality. Vero Moda caters to the needs of the self-driven and ambitious woman who looks for fashion that is effortlessly chic, smart and structured attires that allow her to sail through a busy day. Fashion at Vero Moda is distinctively tailormade with an eclectic mix of the season’s trendiest fashion statements and classic wardrobe staples.

Retail Mapping

The brand is also available at most leading online stores apart from its own website for e-commerce, EBOs and shop-in-shops. Globally, Vero Moda is present in 45 countries.

Domestic Retail Expansion Plans

The brand continues to look forward to explore opportunities in new markets especially in Tier-II and -III cities.

Technology Deployment

Technology is positively contributing to almost all functions of the retail business like operations, supply chain management, marketing, customer accessibility, etc. E-commerce, for example, has allowed brands to reach consumers in places where physical stores are not feasible. Vero Moda is currently working on its Omnichannel strategy.

Omnichannel Presence

Vero Moda’s partnership with Tata CLiQ is one of the strategic alliances in the omnichannel approach. Once ordered on Tata CLiQ , the customer gets the option of either getting the products delivered to him within six hours or collecting the product from the store. The focus is to be as close to the customers as possible.

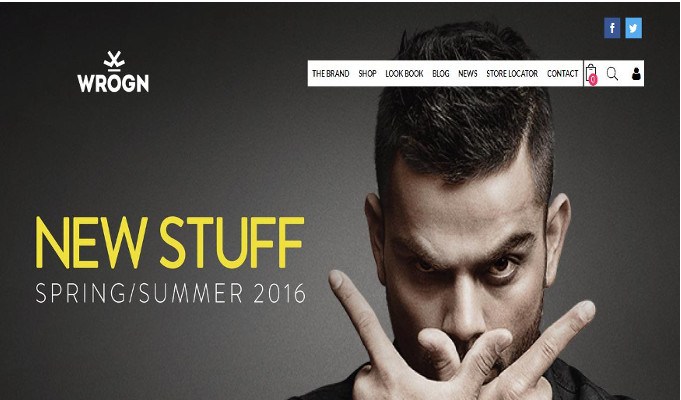

7. WROGN

Founded in 2012, Universal Sportsbiz Private Limited (USPL) consolidated three celebrity fashion brands under its retail umbrella. USPL, a celebrity commerce company, co-founded by Anjana Reddy and Sachin Tendulkar, has Accel Partners on its board. The brand portfolio includes Wrogn, a men’s casual wear brand inspired and co-owned by Virat Kohli; Imara, a contemporary women’s ethnic and fusion wear brand with Shraddha Kapoor; and Ms. Taken, a women’s western wear by Kriti Sanon.

Target Consumer

Wrogn is a casual wear, sophisticated youth fashion brand, for open-minded and progressive men. It targets men in the age group of 22 to 28 years. Wrogn is India’s most quirky youth fashion brand and does not wear blinders and questions everything. Fashion is personal and may vary from one person to other, based on region, skin type, size and other matrix. Wrogn defines the consumer idices with theneedful requirement catering to the consumer segments accordingly.

Retail Mapping

Wrogn is retailed nationally through e-commerce websites like Myntra, Jabong, Flipkart, through large format retail stores like Shoppers Stop, through its brand website along with its exclusive brand store. Wrogn has a strong market share in the South followed by the West, East and the North respectively. Wrogn is currently retailed in India only.

Domestic Retail Expansion Plans

Wrogn is planning to have 100 exclusive brand stores in the next 3-4 years. It also plans to set a global footprint into other countries in the Middle-East, Europe and South East Asia.

Technology Deployment

The brand uses technology to map the colours, silhouettes, patterns and stories apart from the price matrix, sizes, etc. to plan its offering. Tech becomes an intrinsic part of the analysis as the mapping is routed across the respective men’s casual wear category across various brands. Wrogn has adopted software to define the above matrices apart from the stock replenishment module.

Omnichannel Presence

The strategy has largely been through its exclusive brand store and the brand website where the purchasers are mapped and recognised on both platforms for re-targeting with the offering of products. The Omnichannel initiatives are largely activation led to allow the customers to avail offers using the same mode of gratification through online and offline.

8. COURTYARD

Courtyard was launched by Artex Creation in 2015. The company has been a veteran in the denim market since the last two-decades. Under Courtyard, the company specialises in manufacturing blazers, suits, jackets, jeans, trousers, chinos and cotton pants for men and denim range for women.

Brand Mantra

Courtyard aims to provide fast, affordable and fashionable garments. The brand’s mission is to be present in all the cities of the world.

Target Consumer

The brand targets men, women and teens with a fl air for fashion. The brand’s consumers have their own style statement and always seek to try out new fashion.

Brand’s USP

The brand has a no compromise attitude when it comes to fabric and colour. Courtyard ensures that its customers get only the best.

Upcoming Products

As part of its brand extension, the brand will launch Courtyard Teens for teenage boys. It will also introduce t-shirts for men in its product range.

Upcoming Plans

Courtyard is looking to expand in Odisha and Uttar Pradesh markets at a very big scale. At present, the brand is being retailed through 1 exclusive brand store and 350 multi-brand outlets. With the launch of 4 exclusive outlets in the pipeline, the brand has plans to take the franchise route. As of now it has plans for 12 franchisees and is seeking pan India establishment.

9. HOFFMEN

Hoffmen was launched in Kolkata in 1991 offering a contemporary collection of

denims and casualwear for men. In March 2011, as part of its expansion strategy, Hoffmen introduced Ms HFN for women to introduce a complete line of apparel for women. Ever since its inception, the brand has seen many surges and pitfalls during its journey

to be what it is today. Every product that is made at Hoffmen adheres to strict quality checks to provide ultimate comfort and style at affordable price.

Brand Mantra

The brand aims to be the best value for money fashion brand.

Target Consumer

The brand caters to male and female consumers in the age group of 21 to 40 years.

Brand’s USP

Hoff men’s USP lies in being a high quality brand at an affordable price.

Upcoming Products

Hoffmen has already launched its latest casual and semi-casual blazers and suits in the EBO format. The brand plans to make these available at MBOs as well during the festive season.

Targeted Cities

Hoffmen has plans to open EBO’s in smaller towns of Chattisgarh and Madhya Pradesh.

10. APPLEEYE

Headquartered in Kolkata, the modern kidswear brand Appleeye was launched in

2010 by Stitch Fab India Pvt. Ltd. The brand offers trendy apparel for both boys and girls. Adhering to international standards, across all departments from conception to execution, Appleeye is dedicated to install attitude and set new trends in kid’s fashion. Today, it is the first choice for parents and kids who look for comfort and the latest in fashion.

Target Consumer

The brand targets kids and infants from 0 to 16 years of age. Its consumers belong to middle and upper middle class families.

Brand’s USP

The brand’s USP lies in it’s trendy designs, which are at par with international standards and are made available at affordable prices.

Targeted Cities

The brand plans to scale up operations pan India.

Upcoming Plans

Appleeye aims to focus on retail expansion through its own EBO’s in 2018.

11. ETEENZ

Dhananjai Lifestyle Ltd., launched the kidswear brand, ‘Eteenz’ in 1977. With a dream of setting up a world class kidswear unit, Eteenz manufactures superior quality garments. Today, Eteenz is known for off ering exculsive character merchandise like t-shirts, bottoms, frocks and many more.

Brand Mantra

Eteenz captures the spirit of fashion encapsulating all the positive answers pulsating the consumers in terms of design, quality and price. It also aims at launching character merchandise at reasonable price so that everyone can afford.

Target Consumers

The brand targets kids in 0 to 14 years of age group.

Brand’s USP

Eteenz is one of the largest character licensing kidswear brands in India.

Upcoming Products

The brand is planning to launch two new brands, Birthday Girl and Birthday Boy, which will be exclusive party wear brands.

Targeted Cities

The brand aims at expanding its online channel as this modern trading route has seen a major rise in the recent years. Also, it has an extensive plan to expand its distribution channel across the country.

12. TWISTER LEGGINGS AND PINK N PURPLE

Twister Leggings was founded by Late Devi Prasad Jhajharia, back in 1986 with a vision to replenish superior quality products. The organization initially started the production of vests & briefs and then in 2009, and slowly and gradually shifted to ladies bottom wear segment.

In 2009, Deepee® Twister-Churidar was introduced which was seen as an ethnic bottom wear. The product composed of cotton based fabric was highly applauded in the Indian market because of its comfortability, durability, availability of wide range of colours and an exceptional property of four-way cotton stretchable fabric giving the product new heights.

The Research & Development Wing brought out a premium segment – Pink ‘n’ Purple™. It consists of Leggings, Jeggings, Capris, Ankle length, Printed Leggings, Stripe Leggings.

The company has got a strong recognition in the Indian market and has a distribution network in over 15 states in the country.

13. BREAKBOUNCE

Breakbounce has been a part of Goldenseam Industries Pvt Ltd. The brainchild of Sanjeev Mukhija, the founder of Goldenseam Industries, Breakbounce is the the first streetwear brand of the country.

Dominating the menswear category, the brand already has presence in shop-in-shops through partnerships with retail giants such as Lifestyle, Splash, Central and Reliance Footprint. It has a pan Indian reach that is enabled by Flipkart.com, Myntra, Snapdeal.com, Jabong.com and Amazon.in. Apart from this the brand also has its EBOs.

With a huge amount of experience in garment construction and specialization in ‘off the peg’ street- wear, the decision to start his own brand with a distinct international signature came naturally to Mukhija, who is also the Managing Director, Breakbounce.

In an exceedingly competitive environment with a multitude of fashion brands – both Indian and international – Breakbounce began its journey in India in 2012. Headquartered in Bangalore, Breakbounce adopted a strategically different approach from the brick and mortar model universally adopted by most brands.

Breakbounce is a way of life, an ode to the street culture, something that was missing in India until now. It is a quintessential streetwear brand designed to take men’s fashion to the streets. The first exclusive brand outlet opened with the FW15 collection.

With an advantage of backward integration to design, develop and manufacture, the brand has paid great attention to product and its detailing. Its product proposition encapsulates all categories of apparel and provides a more holistic experience of the current international street styles. It includes tees, shirts, jackets, hoodies, sweatshirts, chinos, denims, shorts, belts, headgear, wallets, bags and footwear.

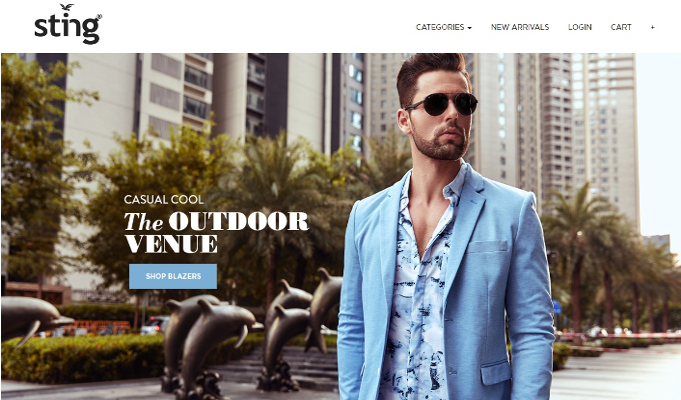

14. STING

In the year 2002, a clothing brand was created to inject dynamism into the dreary world of men’s wear and the brand was given an apt name Sting, the brain child of Blaze Clothing (India) Pvt Ltd having its base in Chennai. The brand has mellowed into a cool metro sexual brand available in all major cities having its own fashion outlet stores and at major multi-brand outlet stores across the country, Sting has its own repute among its customers, who made it grow as an international brand.

Sting has a collection of semi formal and casuals. The current range includes chinos, khakis, corduroys, denims, checks, prints, cotton linen blends, slim fit shirts, wrinkle-frees, T-shirt club wear and many more exciting creations. Recently the brand has introduced a new range of premium sneakers which was inspired from the top notch sneaker brands and have been designed after a plenty of R&D.

15. ROCKSTAR JEANS

Rockstar Jeans was launched with a vision to bring smart, international and urban fashion into the value for money segment. Within just a few years of its inception the brand was able to deliver its promise, steadily establishing a strong nationwide presence for itself and becoming a favourite of every individual who aimed at dressing impeccably. Having partnered with various leading national retailers, the brand is driving its product line comprehensively into every nook and corner of India, including Bihar, Jharkhand and the seven sister states of India. The product range consists of a vast variety in denims, trousers, shirts, t-shirts, and shorts for men.

Brand Mantra

To provide the most recent fashion trends at an aff ordable price range.

Target Consumer

The brand targets men in the age group of 16 to 35 years.

Brand’s USP

Rockstar Jeans has consistently been able to raise the benchmarks for quality and design in its segment.

Targeted Cities

The brand plans to scale up operations in Chattisgarh, Kerala, Karnataka ,Tamil Nadu, Goa and Mumbai.

Upcoming Plans

The brand aims at acquiring better market share from the existing territories and also plans to extend into new geographical locations. Rockstar Jeans also plans to expand its presence through online retailing.

16. MUFTI

Mufti was launched in 1998 with one driving ambition, to provide an alternative dressing solution, that didn’t conform to the ‘uniform’ codes of mainstream fashion. Kamal Khushlani started manufacturing men’s shirts under the label Mr. Mister. Recognizing fashion was the core strength of this fledgling brand, many boutiques deemed this startup label fit for their shelves. Realizing its true potential, and that of the market, the brand decided to move into overdrive. An ambitious project to leapfrog into a leadership position in men’s fashion was initiated in 1998 and Mufti was launched. Mufti is uniquely original in everything it does. Everything, beginning from the name (a term from pre-independence India) to its business values, to its image and advertising, reflects this belief.

USP and Target Consumer

Mufti celebrates fashion and leads with fresh fashion every season. The brand targets metrosexual male in the age group of 16- 40 years seeking fashion as an expression of his individuality.

Omnichannel Presence

Mufti is available on all major e-commerce websites as well as on www.muftijeans.in and are currently experimenting with TataCLiq to link its customers directly with its EBOs.

Retail Mapping

The brand is well penetrated in the country and are now focusing on increasing its presence in the South and Northeast. Mufti retails through EBOs, MBOs and large format stores and is emerging strongly in the e-commerce channel of business as well.

Domestic Retail Expansion Plans

Mufti has aggressive plans but the brand believes in biting as much as it can chew. The fashion brand will venture into associated ranges, but gradually.

Product Basket

Mufti is a premium fashion brand for shirts, t-shirts, jeans, jackets, blazers, sweatshirts and accessories. The brand’s top selling lines are shirts and jeans and the others are growing every season.

17. COLORPLUS

ColorPlus was launched in 1993 and created a niche in the ready to wear market in India by introducing a new dress code to the Indian man – smart casuals. The philosophy of the brand is – colour, comfort and craftsmanship. ColorPlus is a complete lifestyle brand complementing every facet of a man’s personality; be it at work or during leisure time.

The brand owned by Raymond Group, has increased its retail presence aggressively in last 3-4 years. Today, it is one of the fastest growing casual wear brand in large formats.

Target Consumers

ColorPlus targets the modern Indian discerning and successful man who believes in quality and does not mind paying premium for reliability and quality. The target group is between 30-45 years who is well educated and is either a businessman, self-employed or is a professional.

Product Categories & Top Selling Range

ColorPlus products are all made of 100 percent natural fabrics like cotton, linen and wool. ColorPlus retails smart casuals and the range includes chinos, shirts, t-shirts, jackets, winter wear like sweaters, outerwear and accessories like belts, wallets, ties, handkerchiefs, socks and innerwear. Shirts and trousers are the brand’s core categories.

Manufacturing Infrastructure

The brand outsources its garment manufacturing to the best units in India while fabrics come from the best mills of India, Europe, America and Australia.

Success in Online Selling

Raymond launched its website RaymondNext in Oct’16 with all brands of the Raymond portfolio under this website. Although it is at a nascent stage but the brand has already received positive responses.

Growth CAGR in the last 3 years

The brand has achieved double digit growth in the last few years and aspires to continue building on that growth.

Future plans

ColorPlus looks at fulfilling the needs of their consumers based on the insights generated from them and provide them with complete wardrobe solutions.

18. SPYKAR

The Spykar story started way back in 1992 when it was established as a MBO brand specialising in denims. Within a very short span of time, the brand’s fidelity to product quality and customer satisfaction entrenched it as a reputed western wear brand pivoted around denim. Gradually it expanded into the lifestyle space with additional focus on accessories. From a MBO based men’s denim brand to a multi channel lifestyle player with a pan India presence across all retail formats, Spykar has come a long way and today embodies the bold, the brash and the audacious.

Product range

Spykar offers a complete wardrobe for both men and women, with a strong focus on the young and young at heart.

Core domestic markets

The brand has a pan India presence with more than 1,200+ MBOs across 330 cities.

Retail expansion plans

Breaking the confines and expanding the horizon, the brand believes in evolving and expanding its retail footprint routinely. Currently, Spykar has plans to add about 285 stores by 2020.

Potential markets

The brand believes that the tier -II and -III cities of India are still under serviced. The youth in these geographic locations have relatively lesser brand options and hence a huge potential lies there.

Online presence

Spykar is available all leading at fashion portals like Jabong, Myntra, Flipkart, Snapdeal etc. The brand has its own online store as well www.spykar.com. It’s through its online presence that the brand services its tier -II and -III audience.

19. ALLEN SOLLY

Allen Solly an initiative of Madura Fashion & Lifestyle, a division of Aditya Birla Fashion and Lifestyle is India’s largest and fastest growing branded apparel companies and a premium lifestyle player in the retail sector. After consolidating its market leadership with its own brands, it introduced premier international labels, enabling Indian consumers to buy the most prestigious global fashionwear and accessories within the country.

The company’s brand portfolio includes product lines that range from affordable and mass-market to luxurious, high-end style and cater to every age group, from children and youth to men and women.

20. TOMMY HILFIGER

TOMMY HILFIGER is one of the world’s leading designer lifestyle brands and is internationally recognized for celebrating the essence of classic American cool style, featuring preppy with a twist designs.

Founded in 1985, Tommy Hilfiger delivers premium styling, quality and value to consumers worldwide under the TOMMY HILFIGER and HILFIGER DENIM brands, with a breadth of collections including HILFIGER COLLECTION, TOMMY HILFIGER TAILORED, TommyXGigi, men’s, women’s and kids’ sportswear, denim, accessories, and footwear. In addition, the brand is licensed for a range of products, including fragrances, eyewear, watches and home furnishings. Founder Tommy Hilfiger remains the company’s Principal Designer and provides leadership and direction for the design process.

Tommy Hilfiger, which was acquired by PVH Corp. in 2010, is a global apparel and retail company with more than 15,000 associates worldwide. With the support of strong global consumer recognition, Tommy Hilfiger has built an extensive distribution network in over 100 countries and more than 1,800 retail stores throughout North America, Europe, Latin America and the Asia Pacific region.

21. UNITED COLORS OF BENETTON

Benetton Group is one of the best-known fashion companies in the world, present in the most important markets in the world with a network of about 5,000 stores; a responsible group that plans for the future and lives in the present, with a watchful eye to the environment, to human dignity, and to a society in transformation.

The history of Benetton is built on innovation – seen in its bright colors, the revolution of the retail outlet, unique sales networks, and universal communications that have always been social talking points and aroused cultural debate – and now the firm has taken up the challenge of globalisation, with constant investments and a competent, flexible organisation that takes change in its stride.

The Group has a consolidated identity comprised of colour, authentic fashion, quality at democratic prices and passion for its work: these values are reflected in the strong, dynamic personality of the brands United Colors of Benetton and Sisley.

The development of the United Colors of Benetton sales network, which occupies prime positions in historic town centres and shopping centres, is supported by a significant programme of investments around the world. The new stores exploit highly modular settings to create spaces in which the collections, their colours and design are always at the centre of attention, and are presented in a retail context that is increasingly attractive, dynamic and interactive.

22. US POLO ASSN.

U.S. Polo Assn. is the authentic and official brand of the United States Polo Association, the governing body for the sport of polo in the United States since 1890. Today, the products are sold through licensing program in over 135 countries at independent retail stores, department stores and U.S. Polo Assn. brand stores. The U.S. Polo Assn. brand captures the authenticity of the sport, while embracing the genuine spirit known throughout the world as Classic American Style.