Meesho surpassed competitors in several metrics such as transacting users, open rates and install penetration

New Delhi: E-commerce platform Meesho has emerged as the clear winner in the race of Diwali festive e-commerce sales, with its open rate rising exponentially in 2023, in comparison with its competitors in the year 2022 according to a report by conversation media platform Bobble AI.

The report added that the proportion of transacting users on Meesho increased by more than 50% during the same period. As e-commerce giants gear up for the first major sale of the year on the eve of Republic Day, the industry dynamics are changing with Meesho emerging as a significant competition to e-commerce giants such as Amazon, Flipkart & Myntra, thanks to its growth in tier 2 and tier 3 towns.

The market intelligence (MI) unit of Bobble AI studied how different e-commerce platforms performed during the current year’s festive sales. The performance was compared with last year’s performance to understand the E-commerce space dynamically. The research was done in a privacy-compliant manner using first-party data coming from more than 85 million devices.

The four top e-commerce apps: Amazon, Flipkart, Myntra, and Meesho were considered for the study, and the data for the duration of the Diwali sales (in 2022 & 2023) of the e-commerce platforms was considered for the report. Data was adjusted for the difference in the number of days of the festive sales campaign to make the data comparable.

The report has classified the performance of the e-commerce platform in the areas of penetration, average session per user, transacting users and new installs.

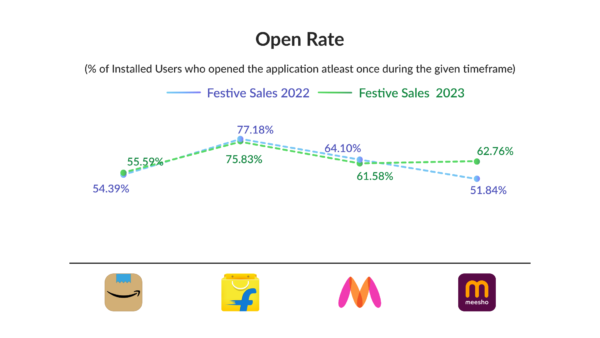

Open Rate: Bobble AI data report suggests that the open rate of competing apps has remained almost constant across the two years. However, Meesho has witnessed a significant jump of about 11% in its Open rate in this period. The lift was primarily driven by the massive increase in the open rate in tier 2 (an increase of 11.92%) and tier 3 (an increase of 13.48%) centres.

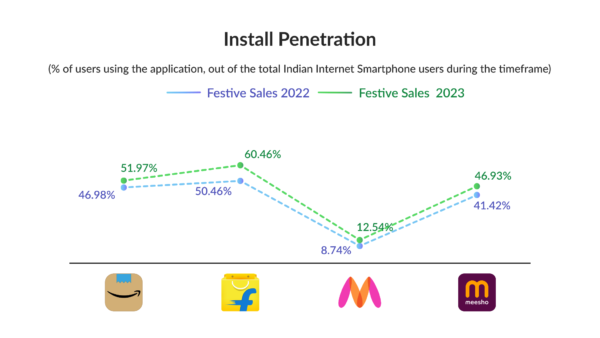

Install Penetration: Figures reveal that the rise in app penetration was the highest for Flipkart (by 10%) with Meesho coming in second with an increase of more than 5%. The install penetration of Flipkart was also accentuated by the rise in demand in tier 2 and tier 3 centres. The improved performance of Meesho in the same centres shows that the general performance of the e-commerce applications is being driven mainly by the tier 2 and tier 3 towns.

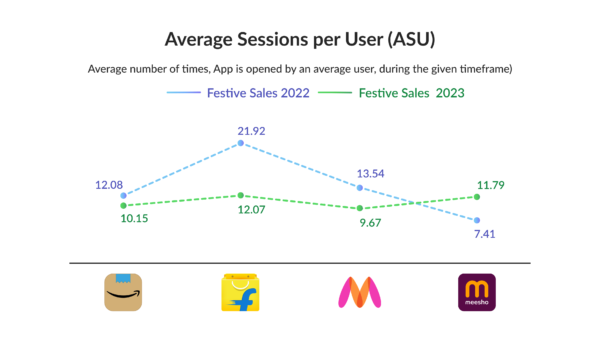

Average Sessions per User (ASU): Session metrics show the level of engagement that the users have with the e-commerce platform. The average number of sessions per user metrics reveal the kind of ground that Meesho is covering among the major e-commerce apps.

The usage patterns of the Bobble platform users suggest that the average number of sessions per user for its competitor Flipkart fell by about 45%, while the fall for Myntra was about 29%. However, in the case of Meesho, the Average Sessions per User increased substantially by more than 59% over the Festive Sales 2022.

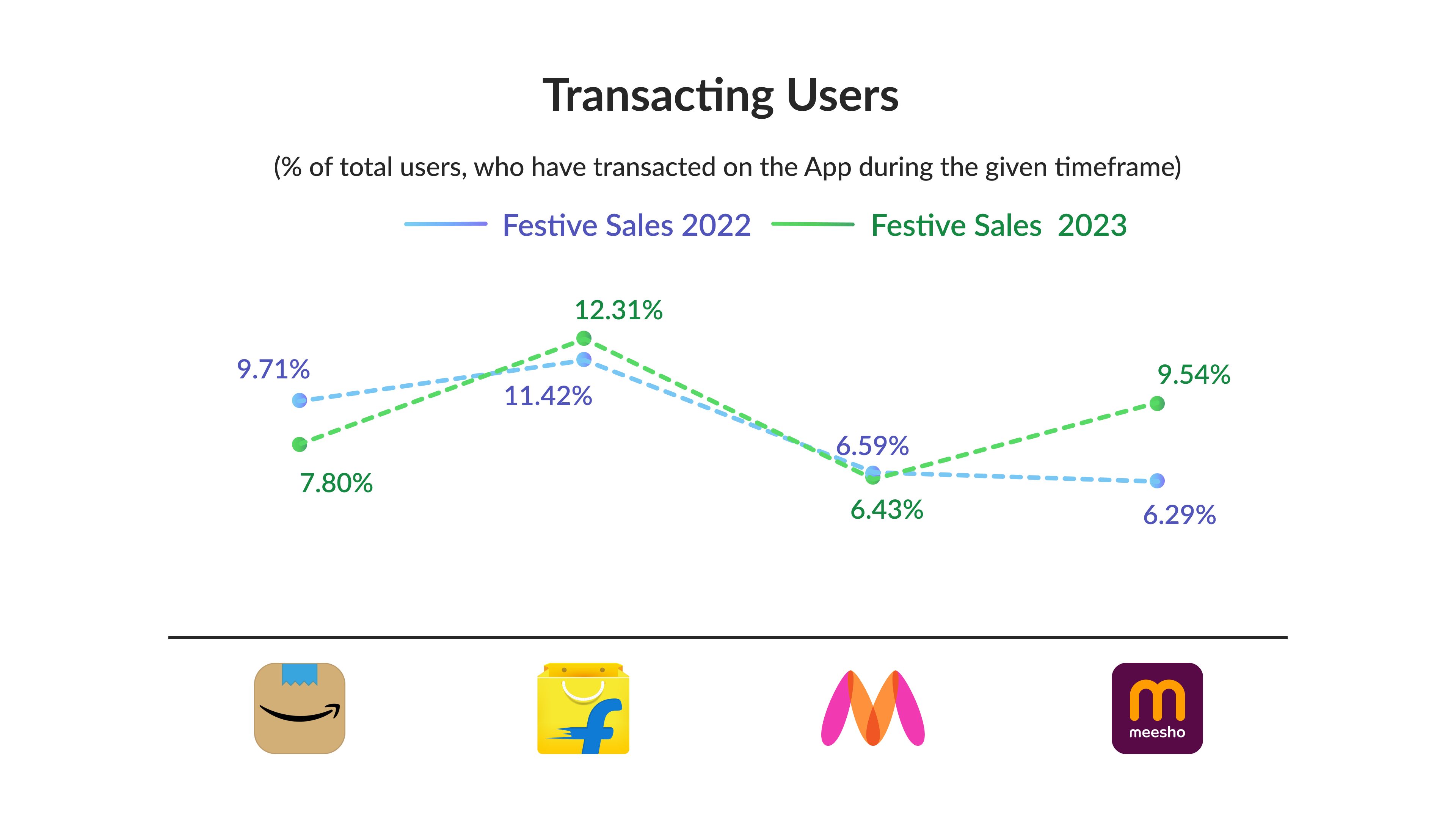

Transacting Users (TU): This shows the kind of business being generated on a platform. The increase in Meesho’s Transacting Users (6.29% to 9.54%) was found to be the highest among all the apps with an almost 50% increase over the last year, followed by Flipkart (11.42% to 12.31%).

For Amazon and Myntra there was a drop in TU with Amazon’s TU falling from 9.71% to 7.80% and Myntra’s from 6.59% to 6.43%.

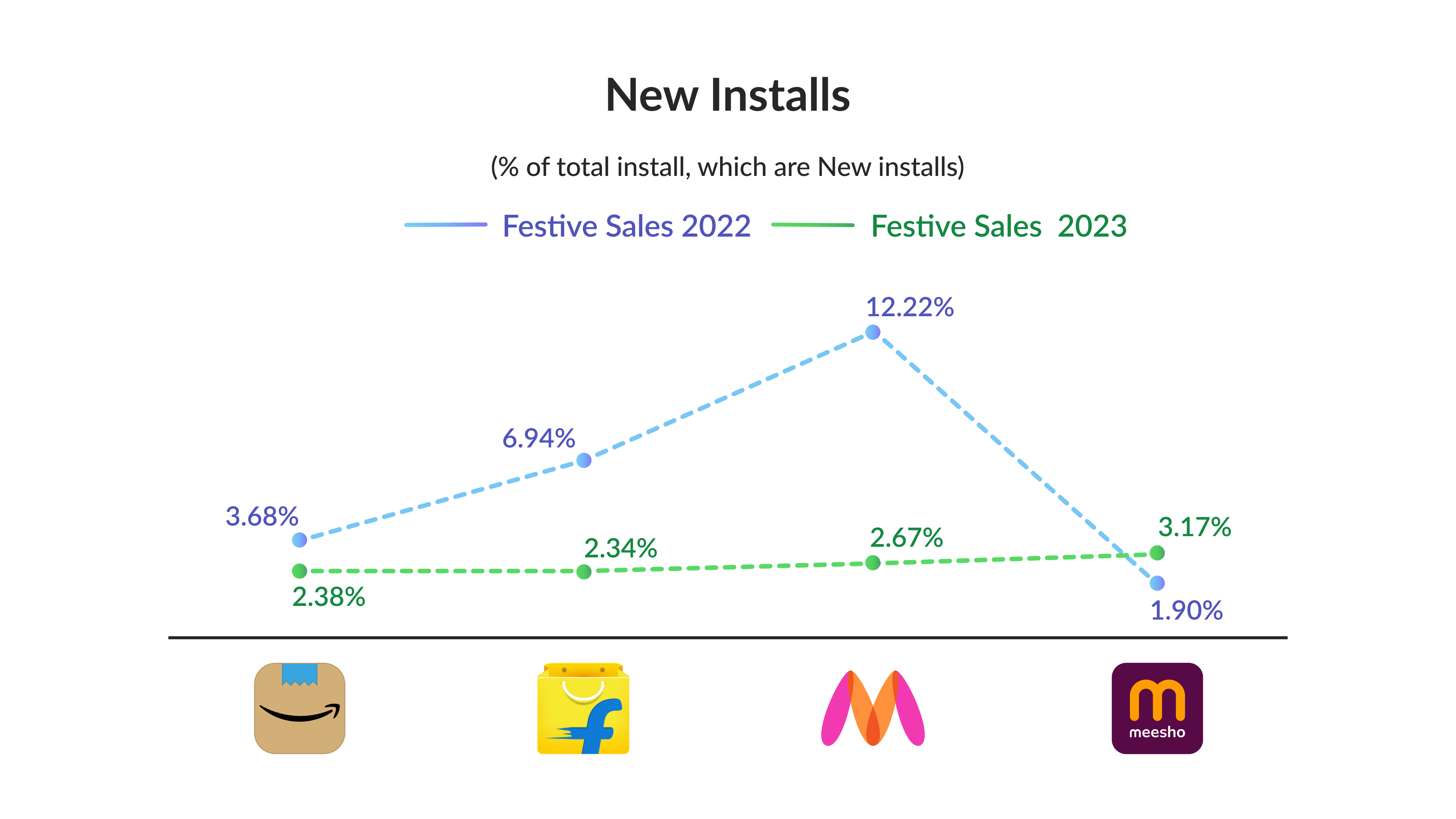

New Install (NI): This shows the increment in users of an app over a given period, the comparison of NI for the Bobble users between the Festival 2022 period and the Festival 2023 period shows that the rate of NI has also shrunk for apps with Myntra facing the maximum slump of around 10%, followed by Flipkart with a slump of more than 4%. However, even in the case of NI, Meesho aced with an increase of more than 65% across the two periods (From 1.90% to 3.15%).

The report goes on to establish that riding on the trust of tier 2 and tier 3 customers Meesho’s performance is improving at the fastest rate which is posing a serious threat to the duopoly of e-commerce giants who rely heavily on Tier 1 customers’ purchase capacity & trust, majorly. Even though the increase in the rate of penetration was the highest for Flipkart, Meesho surpassed Flipkart in the Open Rate, Transacting Users, and other metrics by a long way this is a testimony of the changing dynamics of the e-commerce industry in India.