The top four banks in India claim 75% share of the country’s credit card market offering more than 70 co-branded credit cards. To learn more about the top cards launched with retail brands, swipe down…

New Delhi: According to credit advisory Credit Sudhaar, an average Indian credit card user holds at least two credit cards. And chances are at least one of them is a co-branded card issued by the bank in partnership with a leading retail company.

The Reserve Bank of India (RBI), which regulates credit cards in the country, allows only banks to issue and operate credit and debit cards in the country. Hence, retail companies must tie up with banks to launch co-branded cards.

Today, co-branded credit cards are an important part of a brand’s loyalty offering, replacing brand specific loyalty cards in a consumer’s wallet which had limited acceptance.

More and more retailers are opting to launch such cards as they can be used in places other than the retail company’s outlets, increasing their useability and appeal among consumers, who use them to collect reward points and as plastic money, saving them the hassle of carrying several cards.

The first seven months of this year saw four major co-branded credit cards being launched by leading retail brands.

A quick look at the numbers

India had more than 80.08 million (or 8,0834,596 to be precise) credit cards in March 2023, according to RBI. Four banks—Axis Bank, ICICI Bank, HDFC Bank and State Bank of India—dominate the market, claiming 75% market share. Together, they run 60.8 million outstanding credit cards (as in March 2023) and more than 70 co-branded variants.

The Visa network supports a whopping 70% of the country’s co-branded cards, while Mastercard supports 14% and National Payments Corporation of India’s RuPay 11%.

The benefits

Co-branded credit cards give issuing banks access to a focused customer base, increased average spending per card and improved customer stickiness, as per a PwC report on the topic.

“Retailers benefit as the cards help retain customers and boost sales. They contribute to the top and bottom line with shared revenue, give better brand visibility and enhance customer loyalty,” the report said.

Also, in a co-branded arrangement, charges such as interchange fees and discounts are shared between banks and their partners according to experts.

“Issuer banks earn most of their income through card issuance and interchange fees. The banks will re-distribute the income generated through these fees to the co-branding partner. Alternatively, FIs can also incentivise merchants for every activated card,” the report added.

Here we give you a lowdown on top co-branded credit cards in retail, listen in alphabetical order of the banks issuing them.

Axis Bank

Flipkart Axis Bank Credit Card: Launched in July 2019, Flipkart Axis Bank credit card is a virtual credit card that offers benefits on lifestyle and dining transactions, including an unlimited 5% cashback on Flipkart. Welcome benefits include Rs. 500 worth of Flipkart vouchers, 15% cashback up to Rs. 500 on Myntra, and a 50% instant discount up to Rs.100 on Swiggy.

Subsequent transactions on Uber, Swiggy, PVR, Tata Play, and/or Curefit get a flat 4% cashback. Other benefits include complimentary access to airport lounges.

As per the Axis Bank annual report 2022-2023, there were 3.6 million Flipkart cards in force as of March 2023.

Samsung Axis Bank credit card: Launched in September 2022, the card is powered by Visa and is available in two variants – Visa Signature and Visa Infinite.

According to Amitabh Chaudhry, managing director and chief executive officer, Axis Bank, the card will help Axis tap the wide reach of Samsung India beyond the top 10 cities, aiding the bank’s card penetration into tier 2 and 3 cities. For Samsung, the card is its “next big India-specific innovation” according to Ken Kang, President and CEO, Samsung South-West Asia.

The card offers a 10% cashback across all Samsung products and services around the year, over and above existing Samsung offers, across offline and online channels which include Samsung.com, Samsung Shop App and Flipkart, and at authorized Samsung service centres.

Cardholders also get rewards on BigBasket, Myntra, Tata 1mg, Urban Company and Zomato along with complimentary airport lounge access, and fuel surcharge waiver among other benefits.

ICICI Bank

Amazon ICICI Bank Credit Card: Launched in October 2018, the card aims at rewarding customers for shopping on Amazon and promoting Amazon Prime. The lifetime free card is available only by invitation and also through the Amazon website.

The card gives Amazon Prime members a 5% cashback on purchases made on the marketplace, and non-Prime members get 3% cashback.

Cardholders also get 15% savings on dining bills, a waiver of 1% on fuel surcharge, 1% cashback on shopping at merchants other than Amazon.

According to ICICI bank Annual Report FY 2021-2022, over three million Amazon Pay credit cards were issued till end- March 2022.

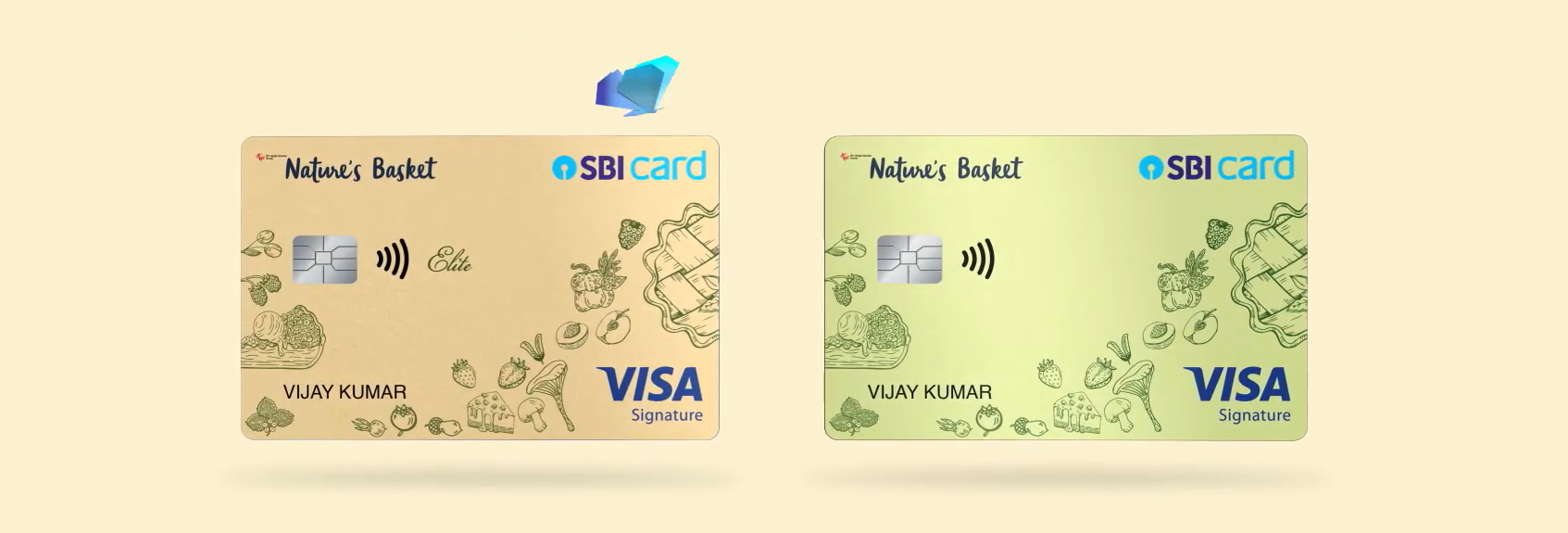

State Bank of India (SBI)

Lifestyle Home Centre SBI Card: Launched in February 2020, the Visa-powered card offers five reward points on every Rs. 100 spent at online and offline Landmark Stores (Lifestyle, Home Centre, Max and Spar) as well as for dining and movies. Purchases at other retailers earn one reward point per Rs 100 spent.

Points received can be converted into Landmark rewards and redeemed for purchases at the Group’s brand outlets.

The card comes with a secure contactless feature. SBI also offers Max SBI Card and Spar SBI cards, which were launched along with the Lifestyle Home Centre SBI Card.

FabIndia SBI Credit Card: Launched in June 2021, the Fabindia SBI Card too is a contactless credit card available in two variants—Fabindia SBI Card Select and Fabindia SBI Card. The card offers holders a direct entry to Fabindia’s Fabfamily loyalty programme at higher tiers (Gold and Platinum).

Welcome benefits include a Fabindia gift voucher worth Rs.1500. Other benefits include, 10 reward points per ₹100 spent at Fabindia stores, three reward points per Rs100 spent on dining, movies and entertainment and complimentary domestic lounge access.

Nature’s Basket SBI Card: Launched in April 2022 on the Visa platform, the Nature’s Basket SBI Card is available in two variants—Nature’s Basket SBI Card and Nature’s Basket SBI Card Elite. Nature’s Basket SBI Card variants enable cardholders to earn up to 20 reward points on every Rs100 spent at Nature’s Basket stores and up to 10 reward points on every Rs100 spent on dining, movies, and international travel. Cardholders can also get complimentary Bookmyshow movie tickets, Taj gift vouchers, Nature’s Basket welcome gift vouchers, and access to higher tiers of Nature’s Basket loyalty program. Cardholders also get express check-out at Nature’s Basket stores and concierge assistance.

Other benefits include complimentary access to domestic and international airport lounges.

HDFC Bank

Tata Neu HDFC Bank Credit Card: Launched in August 2022, the Tata Neu HDFC Bank card is available in two variants Tata Neu Plus and Tata Neu Infinity. The cards are supported by both Visa and RuPay and can be availed through the Tata Neu app.

Cardholders can earn rewards on all spends, both online and in-store in the form of NeuCoins (1 NeuCoin = Rs1). Purchases outside of partner Tata brands, get 1% and 1.5% NeuCoins on the respective card variants. Cardholders also get complimentary lounge access.

Shoppers Stop HDFC Bank Credit Card: Launched in March 2022, the credit card is available in two variants—Shoppers Stop HDFC Bank Credit Card and Shoppers Stop Black HDFC Bank Credit Card. The cards will be available to over 9 million customers of Shoppers Stop attached to its ‘First Citizen’ loyalty programme.

For years, Shoppers Stop had been running a co-branded card with Citibank, which was acquired by Axis Bank when Citbank exit the country. While the earlier card continues to function, the new offering will take centre-stage.

According to Parag Rao, HDFC Bank’s country head for consumer finance, the partners expect to onboard 10 lakh new cardholders in three years through this card. HDFC bank currently acquires 12% of its customers through co-branding. And expects the number to touch 35% in three years.

Holders of this card can get six to 20 Shoppers Stop First Citizen points (SSP) for every Rs. 150 spent on Shoppers Stop private brands, as per the card variant. Other benefits include points for spends on other brands, complimentary Shoppers Stop First Citizen Black Membership (premium variant), access to airport lounges, accidental air death cover worth Rs 3 crore, loss card liability of up to Rs 9 lakh, and emergency overseas hospitalization cover up to Rs. 50 lakh.

Both variants come with accelerated savings and benefits using HDFC Bank platform and portfolio offers via PayZapp and SmartBuy.

Flipkart Wholesale HDFC Bank Credit Card: Launched in March 2023, this is the first co-branded card of its kind in the B2B segment. Aimed at small merchants and kiranas, the card runs on the Diners Club International® network, available in more than 200 countries.

Registered members of Flipkart Wholesale can avail 5% cashback on Flipkart Wholesale online spends along with a host of benefits like zero joining fee.

Members can apply for the card at Flipkart Wholesale stores or through the Best Price Flipkart Wholesale App.

Swiggy HDFC Bank Credit Card: Launched in July 2023, the card is the first such offering from Swiggy. Hosted on the Mastercard network, the card will provide holders with a 10% cashback on Swiggy across food delivery, quick commerce grocery delivery and dining out. They will also get a 5% cashback on Amazon, Flipkart, Myntra, Nykaa, Ola, Uber, PharmEasy, NetMeds, BookmyShow. Nike, H&M, Adidas and Zara and 1% on other spends.

Cardholders will get a three-month Swiggy One membership free and World Tier Mastercard benefits. The card will be rolled out in a phased manner on the Swiggy app in the initial days, after which, eligible customers will be able to apply for it.

In 2020, Swiggy’s rival Zomato launched a line of co-branded credit cards with RBL Bank, which it discontinued in April this year.

Coming soon

Apple co-branded credit card: Cupertino-based premium electronics major Apple too is eyeing a share of the growing credit cards business in India with the launch of its premium credit card known as the Apple Card. The company has been in discussions with leading banks and regulatory authorities as per reports. During his April visit to India, chief executive officer Tim Cook is reported to have met Sashidhar Jagdishan, chief executive officer and managing director of HDFC Bank. Apple is reportedly also in talks with National Payments Corporation of India (NPCI).