ÏNow ABFRL is undergoing a strategic vertical demerger, spinning off its western wear brands from the Madura Fashion & Lifestyle division into a newly incorporated entity—Aditya Birla Lifestyle Brands Ltd.

In a bold strategic move, the Aditya Birla Group has demerged its ₹14,000 crore fashion empire by carving out Aditya Birla Lifestyle Brands Ltd (ABLBL)—home to legacy menswear brands like Louis Philippe, Van Heusen, Allen Solly, and Peter England—from its parent, Aditya Birla Fashion and Retail Ltd (ABFRL).

This split doesn’t just separate balance sheets—it sharpens focus, unlocks value, and gives rise to two leaner, high-growth fashion businesses.

At the helm of this ambitious transformation are Ashish Dikshit, continuing as Managing Director of both ABFRL and ABLBL, and Vishak Kumar, taking charge as Deputy Managing Director and CEO of the new entity. With deep roots in the business and a shared legacy of scaling fashion brands, the duo is expected to architect the next chapter of accelerated growth across both arms of the Group’s retail empire.

This article explores the strategic rationale, leadership structure, and business performance driving ABFRL’s Infinite Reinvention.

The Evolution of ABFRL: From Consolidation to Demerger

The journey of ABFRL began in 2015, when the Aditya Birla Group consolidated its apparel businesses by merging ABNL’s Madura Fashion division and its subsidiary Madura Lifestyle into Pantaloons Fashion and Retail Ltd (PFRL). Post-merger, the unified entity was renamed Aditya Birla Fashion and Retail Ltd (ABFRL).

Now ABFRL is undergoing a strategic vertical demerger, spinning off its western wear brands from the Madura Fashion & Lifestyle division into a newly incorporated entity—Aditya Birla Lifestyle Brands Ltd (ABLBL).

This structural separation marks the second major reinvention of the Group’s retail playbook—transforming a legacy business into two focused engines of growth.

As of December 2024, ABFRL has a pan-India retail footprint of 7.2 million sq. ft., with 1,187 exclusive brand outlets (EBOs) and a growing omnichannel presence.

Why the Demerger Now?

More than a corporate rejig, this move is a calibrated capital strategy with focused intent:

- Unlocking Shareholder Value: Clear, focused narratives for investors in each entity.

- Tailored Growth Levers: ABFRL can now pursue ethnic wear, value fashion, D2C, and luxury; ABLBL deepens its dominance in mass-premium menswear.

- Capital Efficiency: Each entity can chase growth without internal capital conflict.

- Leadership Continuity: Entrusting veterans Ashish and Vishak signals steady execution through bold transitions.

The Post-Demerger Portfolio Landscape

ABFRL will now operate a highly diversified portfolio across high-growth segments, while ABLBL focuses on scale and profitability in western menswear.

Leadership in Motion: Ashish Dikshit & Vishak Kumar

Ashish Dikshit – MD, ABFRL & ABLBL

A quiet strategist with a strong execution record, Ashish has led ABFRL through complex integrations (Pantaloons, TMRW, Forever 21 India), mergers, and category expansions. His dual leadership role ensures:

- Continuity in vision and organizational culture

- Strategic oversight on ESG, omnichannel, and digital transformation

Vishak Kumar – DMD & CEO, ABLBL

The operational brain behind Madura’s success, Vishak’s expertise in supply chain, product, and distribution gives ABLBL a sharp growth advantage. His focus areas include:

- Execution-led growth in core lifestyle brands

- Data-driven pricing and market activation

- Sustained double-digit growth in a crowded menswear market

What to Watch Next

- Stock Market Debut of ABLBL: Analysts expect strong investor traction when listed.

- Expansion Beyond Menswear: ABLBL may launch new verticals in women’s, footwear, or innerwear.

- Acquisition Watch: ABFRL’s focus on ethnic, luxury, and digital may lead to more designer/D2C brand buys.

Conclusion: Infinite Reinvention in Motion

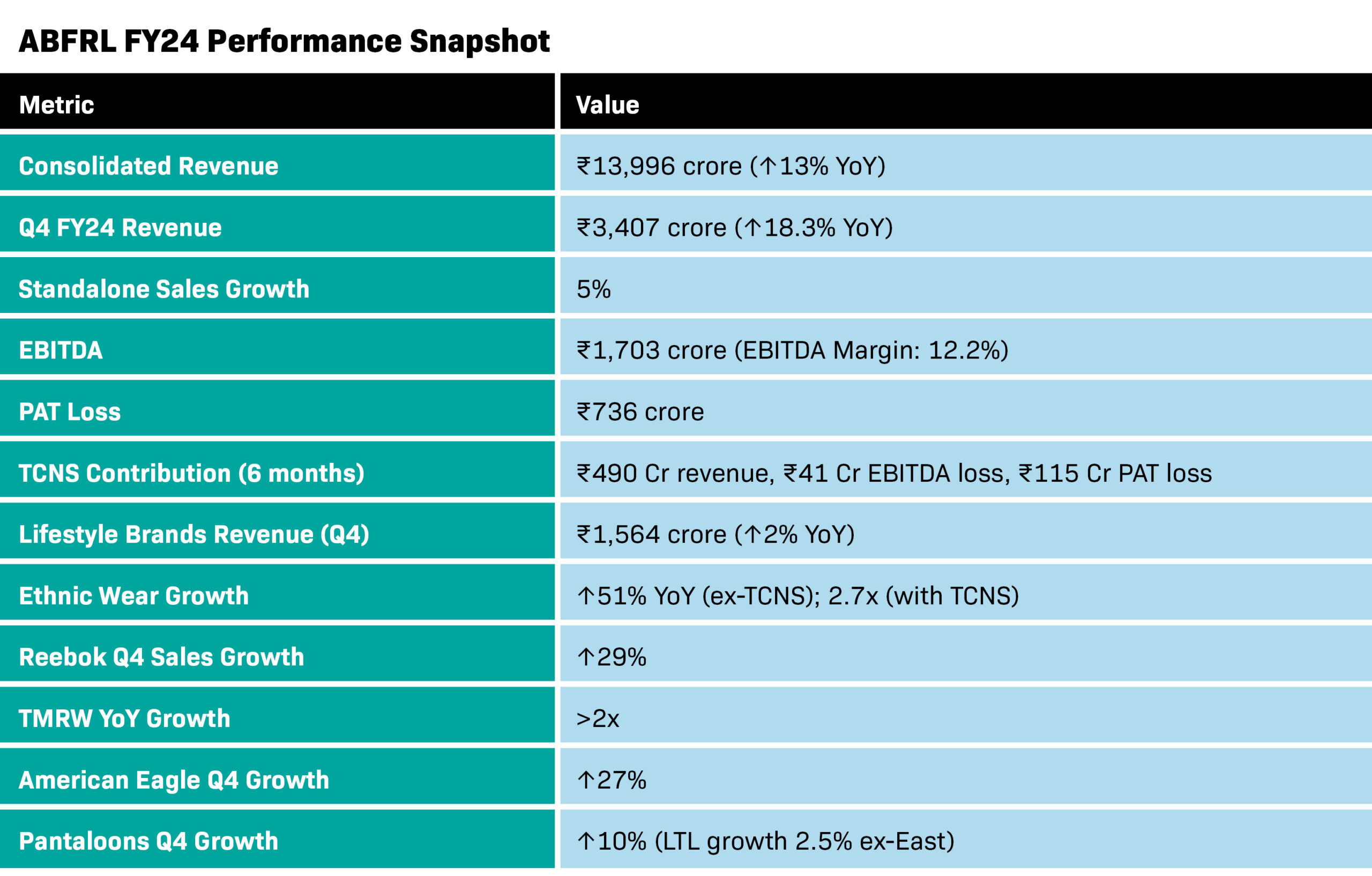

From consolidation in 2015 to strategic separation in 2025, ABFRL’s journey reflects constant reinvention. Today, with a Rs.14,000 crore retail portfolio now split into two sharp business models—one rooted in mass-premium lifestyle dominance and the other in high-growth, high-margin verticals—the Aditya Birla Group is future-proofing its retail leadership.

Under the steady hands of Ashish Dikshit and Vishak Kumar, investors and industry stakeholders can expect sharper execution, bolder innovation, and infinite reinvention across the board.