With Indian consumers increasingly becoming conscious of their consumption choices – especially those reflecting their style and personality – the handbag market in India has witnessed an evolution. The fashion accessory has gone from being a mere necessity purchase to gaining a foothold in the lifestyle shopping category.

The market, which a decade ago had only a few noteworthy national brands like Baggit, Hidesign, Da Milano, among others, is today crowded with not only exclusive domestic bag brands but a number of international brands including Tumi, Piquadro, Louis Vuitton, among others. Besides, the segment has also seen various shoes and apparel brands extending into the category of bags and wallets – from Bata to UCB to Arrow and even Titan.

The handbags market in India can be segmented into four categories: totes, shoulder bags, purses and wallets, satchels and saddles. Purses and wallets are the largest segment, according to a report, in terms of both revenue and volume, accounting for 34.8 per cent and 35.4 per cent share of the market.

Experts believe, changing roles of Indian women, acceptance of quality products over price, the rise in disposable income and opening up of retail avenues in India has lead to the growth of the overall handbag market in India.

“Today, more and more India women’s have come out from their traditional roles to accept other challenging roles. This movement has elevated the demand as well as consumption of the handbags, making it a rapidly growing market in India. Earlier, they would survive from one bag but today they are going out more often and they demand bag for each and every occasion. It has truly become more like a lifestyle choice rather than a necessity,” said MD & Chief Design Curator of Baggit, Nina Lekhi.

“Today, more and more India women’s have come out from their traditional roles to accept other challenging roles. This movement has elevated the demand as well as consumption of the handbags, making it a rapidly growing market in India. Earlier, they would survive from one bag but today they are going out more often and they demand bag for each and every occasion. It has truly become more like a lifestyle choice rather than a necessity,” said MD & Chief Design Curator of Baggit, Nina Lekhi.

Corroborating the thought, Founder, Hidesign, Dilip Kapur noted,” With the opening up of the retail markets, the average consumer has become exposed and far more aware of the brands available in India. Bags are not seen just as necessities for carrying keys or mobiles anymore.”

He added, “Modern Indian women increasingly insist on handbags that express both their personality and sense of style. Unlike clothes, the same bag gets used regularly, and therefore consumers prefer to make a sound fashion investment in a good bag. Women buy bags not just for their potential to last for a long time or because of their designs, but also because the bags express values that they as people relate to.”

In addition to an influx of various players, the market is also witnessing an increase in revenues and volumes.

According to a report by Research and Markets, “Increase in urbanization and rising income levels in India has opened the envelope for growth in handbags market in India. It is even influencing the demand for expensive and premium handbag brands and per-capita consumption by consumers.”

The report also said that, in terms of revenue and volume, the handbag market is expected to grow at a CAGR of 19.2 per cent and 15.1 per cent, respectively, over the period 2014-2019.

New Avenues For Growth

Shopping trends have drastically changed post the advent of online retail and it is no different for handbag category. All the players, in the past, have extending their reach by going online, through big marketplaces like Amazon, Snapdeal or Flipkart and/or their own portals.

“Online has definitely become one of the important channels for us. It’s just all the more convenient for consumers who today want to sit in the comfort of their homes, browsing pages of websites before making a final purchase,” said Baggit’s Lekhi, who is present online through her own website and other marketplaces.

The company, which currently has presence in 71 cities across India with 48 exclusive Baggit outlets (company owned + Franchise owned) and 300 MBOs, pushes more discounted merchandise online vis-a-vis stores for its price-conscious customers.

“Online consumers are always on a look out for more deals and discounts. Therefore, we try to place more discounted merchandise there as it gets picked faster. The channel currently contributes 7-11 per cent of our overall revenue, and we surely see it growing going forward,” she added.

Overall, from FY ’14-’15 to FY ‘15-‘16, company’s topline revenue (gross sales) has grown by 11 per cent.

While, for Hidesign, who just like Baggit sells through own website and e-commerce partners, the total percentage of online sales stand at approx 20-25 per cent currently.

While additional sales channel is one, e-commerce also enables the players to penetration deep in the cities and states where they have no offline presence.

“Online shopping has definitely increased the demand for our products. It has helped us to cater to those markets where our stores are yet to open,” said Chief operating officer of New Delhi-headquartered Da Milano, Sahil Malik. The company currently operates 44 company owned and self-operated exclusive showrooms in 10 cities.

Battling Intense Competition

While the category is booming because of increase in demand and avenues, the retailers agree that the competition has made it a little tough to survive.

“We have seen a lot of national and international players entering the market lately. While not all of them will be able to reach out to the target group, the competition has become a little stiff with international players in the market,” said CEO, Bagzone (the company behind the brand Lavie), Sandeep Goenka.

In the same wavelength, Lekhi said, “For us, functionality and quality of our products have helped us survive the competition and hit the right chord with consumers. The fact that all our products are recyclable and eco-friendly also resonates well with them. However, we won’t deny tough fight from the competition.”

In order to keep this at bay, the company has been expanding its category and has also re-visited its merchandising strategies as per cities they are present in.

For instance, the company launched its men’s range last year, looking to scratch the segment its competition has already entered. They also ventured into making accessories like caps, belts, multi pockets like iPad, laptop and mobile covers and utility kits.

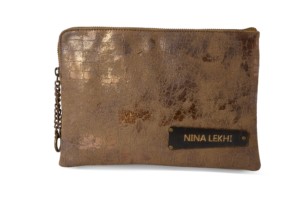

“I also launched my own Nina Lekhi range. At distribution side, we have started looking at supplying right merchandise at the right location because the choice and preference of consumer sitting in Chennai is quite distinct from those sitting in Delhi or Mumbai. They (Chennai consumers) might opt for more muted colors as compared to other consumers. So, it’s important to place right merchandise, with right depth at a right place to get desired sales.”

“I also launched my own Nina Lekhi range. At distribution side, we have started looking at supplying right merchandise at the right location because the choice and preference of consumer sitting in Chennai is quite distinct from those sitting in Delhi or Mumbai. They (Chennai consumers) might opt for more muted colors as compared to other consumers. So, it’s important to place right merchandise, with right depth at a right place to get desired sales.”

However, Lekhi believes the market is quite huge and there is a scope for growth for everyone.

“Trendy, formal, chic or something in between – the handbag demand keeps on changing as per consumers preference and taste. So, I feel the market and opportunity is quite huge for everyone. They just have to come up with the right product,” she added.

As for Baggit, the company has some robust expansion plans. “We are looking to open 50 new stores by the end of next year, especially targeting tier II and III cities. We are working towards opening at least one store in each city of India,” concluded Lekhi.

(With inputs from India Business of Fashion Report 2015)

From necessity to style statement, handbag retailing witnesses a chic transition

Experts believe, changing roles of Indian women, acceptance of quality products over price, the rise in disposable income and opening up of retail avenues in India has lead to the growth

Must Read