India’s youth driven denim market promises unmatched value as well as volume growth as perhaps no other fashion category. Senior Vice President – Fashion, Technopak, Amit Gugnani and Research Associate – Fashion and Textile, Technopak, Sakshi Chillar size the market and delve into its dynamics including taking a look at its online performance…

The Indian apparel market has demonstrated impressive growth in the past decade. The domestic apparel market is expected to grow at a CAGR of 10 pc and expected to reach Rs 7,35,905 crore by 2025 from its present worth of Rs 2,72,666 crore. The Indian apparel market has seen growing inclination of consumer towards western wear and casual wear. Denim is a key category which has seen a positive growth.

1Denim Wear: Market Size & Growth

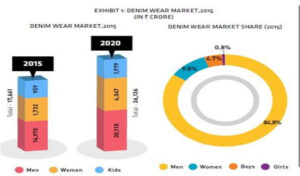

The denim wear market is estimated to be Rs 17,661 crore in 2015 and is expected to grow at CAGR of 15.4 per cent to reach Rs 36,110 crore by 2020. The market in India is dominated by men’s segment, accounting approximately 85 per cent of the total market size. However, women’s denim wear segment is expected to show higher CAGR of 18.5 per cent than men’s segment (15.0 per cent).

2Denim Market Dynamics

The denim wear market is dominated by the unorganised sector, accounting to approximately 65 per cent of the total market. Further, unbranded denim wear products account for 60 per cent of the total denim wear market and offer intense competition to the branded segment.

However, with many private labels and international brands entering Indian apparel market, the inclination towards branded denim wear is increasing in consumers. The increased consumer preference towards e-tailing is giving boost to organised and branded retail of denim wear.

3Online Penetration of Denim

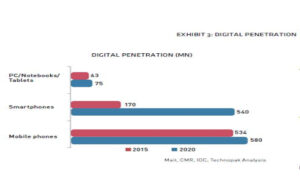

Increased penetration of digital technology cannot be ignored. Between 2015 and 2020, the number of smartphone users is expected to increase rapidly from 170 million users to a stunning 540 million users. The number of mobile phone, PC and notebook users too is also expected to surge. This deep penetration, alongside improved access to the internet, is rapidly impacting consumer behaviour. Online and mobile phone-based shopping is gaining momentum among Indian shoppers especially in the metros.

However, despite the rapid burgeoning e-commerce, it is believed that online purchasing of denim wear has not yet become as popular in India as other apparel and non-apparel categories. This is possibly because e-tail of denim jeans is indeed a challenge. Jeans represent a highly customised category; shoppers prefer to personally feel and embrace the product’s fit before making a purchase decision. Also, there are various options available as per body types and consumer preferences, which make finding the perfect pair of jeans complex. For instance, if we look at different cuts for women’s jeans alone, there is the classic cut, relaxed fit, boot cut, boyfriend style, tapered, skinny jeans, jeggings etc.

Further, denim brands usually have a strong heritage and thus claim different associations with their customers. They portray themselves through diverse expressions, such as modesty, sex appeal, relaxed nature, and nonchalance. Brands’ marketing strategies are based on this same set of associations in the physical store space. However, websites are not able to evoke the same degree of inspiration in the minds of the consumers and thus do not generate huge online sales. Websites of denim brands need to display brand aesthetics, image and story just like physical stores. Some global brands have been able to deploy their websites as a strong communications tool as well as a sales portal. Indian denim companies can adopt best practices from those in the west, and aim to improve their online offerings to achieve more success in denim e-commerce.

What matters substantially in terms of online denim sales is the brand. Given that consumers cannot touch and feel or try the product when they buy online, companies with high degree of brand familiarity and positive brand association are more likely to achieve success.

Lucrative market opportunity has attracted many pure-play e-tailing players to the lifestyle space. E-tailing players are customising their online portal to attract the youth who seek style and trendy look in their fashion products. Lucrative offers from the retailers like ‘cash-on-delivery’, ‘try-and- buy’, ‘easy return policy’, etc., are making e-tailing space competitive and dynamic.

4Growth Drivers and Key Trends

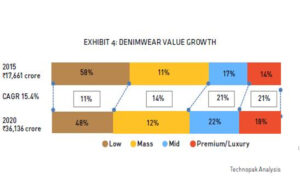

The value growth within the denim wear owes to increased demand for enhanced product attributes: fashion quotient, stretch and light weight fabric, varying colours, styling and detailing. This trend is emerging across both men’s and women’s segments. The above factors shall combine to drive relatively higher levels of growth of the mid-premium and premium/luxury segments.

Targeting rural and sub-urban consumers had been a challenge for denim industry. However, recent trends have indicated increased penetration of denim category across semi-urban and rural centres which shall drive volume growth across mass market and unbranded segments.

5Per Capita Jeans Consumption

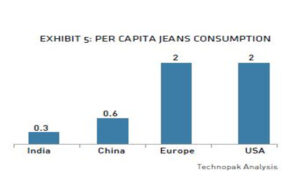

Per capita jeans consumption in India is much lower than that of developed markets; hence there is huge scope of growth in Indian market.

Youth as a growth driver: Youth (15 to 29 year olds), which make 26 per cent of the consuming population, are propellers of denim consumption. Quality and brand conscious youth with higher spending power find denim as their key preference owing to its versatility as an anytime and anywhere wear.

Changing classification of consumer’s wardrobe: The changing classification of consumer’s wardrobe has also acted as a driving force for the casual wear and jeans market in India. 10-15 years ago, Indian consumer was satisfied with need based purchase. The fashion basket then was dominated by formal shirts, trousers, sarees, salwar kameez etc. The key purchase parameter for these fashion items were basic function, comfort and price. However, with increasing exposure to international fashion trends, Indian fashion consumer now wants more than the need-based clothing. Consequently, fashion basket has expanded to include clothing like sports/gym wear, occasion specific ethnic wear, jeans, etc. In addition to the old parameters like basic functionality and price, better look, perfect fit and latest trend have also become key purchase parameters.

Alternative retail channel: Alternative apparel retailing is evolving in India at a rapid pace; jeans are no exception to this trend. Direct selling, home shopping and e-tailing are gaining momentum in the market. There was a time when growth of alternative retailing of fashion was in question as experts thought touch and feel are the most crucial parameters in decision making. However, e-tailing of apparel has gained wide acceptability in India as well as across the major consuming countries of the globe.

Others: Increased penetration of denim category across semi-urban and rural centres shall drive volume growth across mass market and unbranded segments. Entry of more foreign jeans brands into India is expected in future, which may increase the denim market especially in terms of value.

Also, denim is finding ways into other components of the wardrobe, light weight denim shirts, denim shorts, Indigo dyed tees, accessories out of denim fabrics etc.

6Conclusion

With growing penetration of online channels, brand recognition and quality consciousness; there is huge opportunity for growth in denim wear. The large youth population, infiltrating urbanisation and growing preference towards western wear in semi-urban and rural areas are acting as a boost to denim industry.

With right knowledge of consumer preference, opting for online channels, omni-channel retailing and global best practices, denim wear brands can exploit the available growth opportunities in domestic denim wear market.