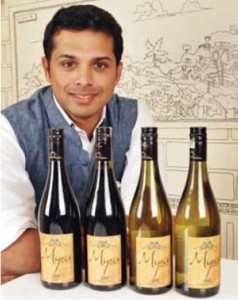

With the passion of bring a paradigm shift in the wine-drinking culture by introducing quality wines for different segments at pocket-friendly prices, Ajay Shetty, investment banker turned winemaker talks about the Indian wine industry scenario.

As a wine producer, please share your insights and learnings as to how you see this market evolving?

I see a great opportunity to grow as our Indian wine industry is at a cusp. People in India started accepting wines as a fun drink, and this could be also due to their exposure to global culture, lifestyle and trends. The wine consumer base in India is increasing and expected to double in size.

As a wine producer, what are your suggestions for retailers on building a reputation for trust, quality and value for customers for their wine section?

Retailers should not just buy and stock wines based on what they get in return but rather should focus on the quality and value that wineries stand for.

A lot of retailers squeeze big discounts out of the manufactures. As a result they compromise on the quality and value. For start-ups like Myra it gets very difficult. Retailers should hire wine-educated people who can pick and choose wine that can work in the market on the basis of their quality. As producers we could hold wine-tasting sessions at supermarkets to let the consumers experience our product. Retailers could potentially make recommendations to the consumers. The recommendations could be in the form of word of mouth, picks of the season, food pairings etc.

Does it make sense for companies to start selling wines online because of the potential for growth?

Does it make sense for companies to start selling wines online because of the potential for growth?

E-commerce has evolved immensely in the past decade. Making purchases sitting at home or work is more convenient. It also gives us the luxury of choosing from a wider range as well as the benefit of price comparisons. Selling wines online has its own advantages and setbacks. I feel that where on the one side we have a wider audience, better visibility, and the convenience of doorstep delivery to the consumers, on the other hand consumers might be skeptical about buying since they cannot taste the wine before making the purchase.Having said that, we would love to sell online but due to the excise laws there are limitations to selling online. Secondly, the cost factor of transporting cases per bottle outside the country becomes hard.

In this case we rather look for distribution channels.

What are the challenges you face in terms of distribution and retail? What can be the solutions to these hurdles?

Marketing for a wine brand comes with its own limitations since wine is bracketed under ‘alcobev’, which leaves us with surrogate marketing and advertising. The other challenge I see is the intensifying competition in the industry. International wine brands are entering the Indian market and new home players as well, which in a way it is good as it gives the domestic players a healthy competition to face and it pushes all of us to produce quality wines at international standards.

What do you think are the category trends and consumer demands for the wine segment?

The number of pubs and hotels that serve wine has been growing. The wine drinking population continues to grow rapidly. Clubs and restaurants organise wine-tasting sessions, which promote the consumption of wine. Manufacturers also organise wine-tasting tours and introduce innovative concepts, such as wine tourism, which creates awareness of wine in India. Currently, the consumer demand is on the premium to the luxury segment but the trends are also shifting to entry level wines as well.

What are the underlying causes and factors hampering the category’s growth?

To begin with, we would like the Government to declassify wines from the broader liquor business and put it under the agro-based and food processing sector. Wine shouldn’t fall into the liquor category. Production of liquor and alcoholic products requires to pass through strict regulations in the form of licences and permits, without which one cannot initiate production. Further, inter-state transfers are very difficult due to stricter regulations and permits and higher excise duty levies. This definitely hampers the kind of growth we would like to see in the segment

People in India started accepting wines as a fun drink, and this could be also due to their exposure to global culture, lifestyle and trends

Must Read