Earlier this month, Ratan Tata-backed online furniture retailer Urban Ladder sought approval from the Department of Industrial Policy and Promotion (DIPP) to open offline stores across India.

Urban Ladder follows Flipkart-owned fashion retailer Myntra’s model, who in July this year announced its plans to open the first store with private brands by end of this month.

At a time when offline retailers are rushing to reach online, does the reverse strategy (Online to Offline) make sense? The answer may very well be yes!

Read: E-tailers look to bridge the gap between online, offline worlds

In the current retail scenario where developing an Omnichannel identity is a must for brick-and-mortar retailers, the rationale for online retailers for adopting the reverse strategy (online-to-offline) holds equal relevance.

Take for example America’s e-commerce giant, Amazon, who made headlines in the year 2015. After over two decades of existence as the online major, the company decided to blur the lines between online and offline world with its first-ever brick-and-mortar retail store in Seattle’s University Village in the US.

For years, the retailer has threatened physical retailers on price because it didn’t have brick-and-mortar locations. But those offline stores offered something Amazon couldn’t: the instant gratification of owning an item the second it was purchased, as well as the five-senses’ experience for customers.

Just like Amazon, various e-tailers in India also took notice and a slew of pure-play e-tailing companies in India opened physical stores to either assist their online sales or to deliver a more real, ‘five-senses’ experience for customers. And now, these retailers are beginning to see significant contributions to revenue and bottom line from their physical stores.

Read: The O2O Retail Model: Will the reverse strategy work?

Here, we take a look at the seven e-tailers who are early adopters of hybrid retail model in India.

1FirstCry

FirstCry, a retailer of baby products, started its online portal in 2010 and soon went on to launch its first brick-and-mortar store in 2011. It was among the earliest online retailers to open offline stores. The company currently operates 170 franchise stores and aims to take the numbers to 400 by 2017.

For FirstCry, the rationale behind opening offline stores was to provide a ‘touch-and-feel’ experience to its customers. “About 85 per cent market is going to remain offline even after five years, however hard we try to push e-commerce. Online shopping is convenient but it does not give that touch and feel experience, which customers in my segment would want,” CEO and Co-Founder, FirstCry, Supam Maheshwari, told Indiaretailing Bureau in an earlier interview.

2Lenskart

Founded in November 2010, Lenskart started as a pure-play online retailer and moved on to open its first franchised brick and mortar store in 2014. Currently, the company operates 200 franchise offline stores.

Read: From neighbourhood opticians to multiple touch points, eyewear retailing gets a makeover

For Lenskart, offline stores are a way to provide hassle-free online purchase options. Company’s CEO and Founder, Peeyush Bansal, calls it an assisted e-commerce model; where some of its consumers directly purchase online, some need help while they purchase and some need post purchase assistance. All these consumers are taken care of by having services like offline stores, free home eye check-ups and 3D trial online.

“Eyewear is not an impulsive purchase; most consumers do not purchase eyewear as they are not aware that they need it. By having an Omnichannel presence eyewear retailers would be able to boost the touch points and be able to reach a maximum number of consumers,” Bansal told Indiaretailing in an earlier interview.

3Yepme

Online fashion retailer, Yepme is relatively a new entrant among the O2O players in India. The company opened four stores in Gurugram earlier this year and aims to open 400 offline stores by fiscal end.

For Yepme, offline stores are part of the companies goals to reach and tap small town consumers who contribute maximum in the overall sales. The company says it gets 30 per cent of its sales from the developed metro markets and rest 70 per cent from tier II, III & IV places, and to tap those regions extensively, Yepme would like to have a network of 1,000 stores in next four to five years.

Read: Yepme aims to have 400 offline stores by fiscal end

“There are more offline consumers than online. Most big brands have a mind block as far as online is concerned. As a fashion brand, you have to see the reality of the business. 80 per cent of the customers who came to our first brick-and-mortar store then never visited our website because they didn’t think they could buy fashion online. We are hoping to convert these consumers into Omnichannel users over time,” Yepme CEO and Co-founder Vivek Gaur, told Indiaretailing Bureau.

To add to the overall shopping experience, Yepme’s brick-and-mortar stores have digital screens where customers can browse the online store as well and place orders, if for instance they don’t find their size in the physical store. The brand has successfully managed to sync both the physical and e-store with real time pricing.

4Pepperfry

Pepperfry joined the growing list of e-tailers going offline in August last year by leasing a 18, 00 sq ft space at Linking Road, Santacruz, Mumbai.

Known as , Studio Pepperfry, the experiential stores do not serve as a sales point, but as a physical store where customers can interact with company staffers as well as touch and feel the products.

The company currently operates 8 such stores in Mumbai, Bengaluru, Hyderabad among others, and plans to open 10 more studios across key metros in the country by the end of 2016.

5Zivame

Just like Pepperfry, Zivame’s offline stores are more like an experiential zone — known as fitting lounge– for consumers who are not comfortable buying online. The stores only act as customer touch points and do not store inventory. The company opened first such store in Bengaluru’s Indiranagar area in December last year.

The company has seen 80 per cent conversions from its Bengaluru store and Zivame now plans to set up more offline experience stores and even aims to scale up to 50 such customer touch points by next year.

Chief Executive Officer, Zivame, Richa Kar, reportedly expects these stores to contribute 50 per cent to the company’s revenues in the next year and a half.

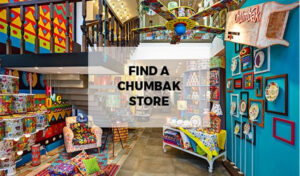

6Chumbak

Known for its ‘India-inspired’ quirky products, Chumbak started its journey way back in 2010 by selling its products online. But soon realised that six sense experience is important for its customers to make a final purchase.

The brand scaled offline territory by selling products in pop-up stores inside the malls. However, In September of 2014, Chumbak launched its first flagship store in Bengaluru which also marked its entry into home furnishings and decor categories.

With offline stores, the brand not only reached more people but also transform its identity from a souvenir store to a lifestyle brand. The company aims to end the year with 10-12 flagship stores and taking this number to 60 or more stores in the near future.

7Caratlane

Started in 2009 as a pure-play jewellery e-tailer, Caratlane today operates over a dozen offline stores across the country. The physical stores for Caratlane function more like a showroom, tending to be smaller than its brick-and-mortar peers.

The stores only act as customer touch points and do not store inventory.

Recently, Titan picked u majority stake in the company, investing Rs 357 crore for a 62 per cent stake.