India was one of the fastest growing retail e-commerce markets in 2015, growing at the rate of 129.5 per cent Y-o-Y. The growing number of Internet users in the country helped web merchants in steadily whittling away consumers’ skepticism about buying goods and services online.

Here’s a look at some interesting facts and features about the Indian e-commerce sector…

Sources:

- IAMAI-IMRB Digital Commerce report 2015

- IAMAI report: E-Commerce Rhetoric, Reality and Opportunity

- PwC Analysis: Evolution of E-Commerce in India by ASSOCHAM

- PwC: E-commerce in India, A Game Changer or the Economy, by CII

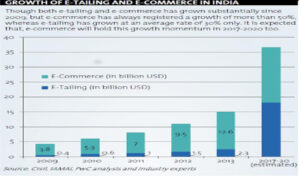

1Growth of E-commerce in India

There are ‘only’ 300 million Internet users in India – only since this number is almost negligible keeping in mind the 1.3 billion population strength of the country. However, that has not stopped Indian consumers from recording a 30 per cent CAGR in digital commerce in the last fiscal year.

Declining broadband subscription prices, and the launch of 4G service have become the driving forces of e-commerce in the country. From buying groceries to furniture, from apparel to accessories, and beauty products and jewellery to ticketing – e-commerce has greatly empowered the Indian consumer. In fact, so much so that India will see more people come online than any other country in the next 15 years.

With the penetration of digital devices and social media in the interiors of the country, online sellers have been presented with an unprecedented opportunity of growth, becoming extremely attractive to investors.

Though retail e-commerce still holds a small share in the total retail sales in India (approx 1.7 per cent as recorded in 2015), industry experts believe it is still in the embryonic stage and has immense growth potential. E-commerce is expected to acquire 4.8 per cent market share in total retail sales by 2019.

2Size & Key Highlights

Size & Growth

The e-commerce market in India has grown at a CAGR of about 30 per cent between December 2011 and December 2015 and stands at Rs 125,732 crores.

Key Highlights

Key Highlights

India’s most favourite purchase online in the non-air travel category are electronics and electrical appliances.- E-commerce currently is attracting a lot of investment with food delivery, and fashion and jewellery retailing being the most lucrative segments, contribute close to 49 per cent of overall spend.

- E-tail has grown by 57 per cent since December 2014 with horizontal marketplaces being clear winners. In 2015, $9 billion flowed into Indian startups, with ShopClues, Flipkart, Snapdeal and Paytm bringing in a fourth of the amount.

- Online travel continues to hold lion’s share of the overall Digital Commerce spends at 61 per cent and valued close to Rs 76,396 crores. Domestic air ticket booking and railway ticket booking are among top categories in online travel space, that contributes close to 70 per cent of online travel spends.

- E-tailing continues to remain the most dominant category among non-travel online spend, maintaining a strong performance with a 57 per cent Y-o-Y growth between December 2014 and 2015. The market moved from Rs 24,046 crores to Rs 37,689 crores between December 2014 and December 2015.

- Among e-tail categories, mobile phone and mobile accessories continue to be the top contributor to the overall pie. Given that there is an increased demand for smartphones in India, this could be a contributing factor.

- While Flipkart sees the highest sale numbers from the mobile phone and electronic categories, Fashion is where vertical players shine. Flipkart-owned Myntra and Jabong, and other well-funded players like Wooplr, Voonik, and Limeroad are playing on a huge customer base.

- Computer and consumer electronics, as well as apparel and accessories, account for the bulk of India retail e-commerce spends contributing close to 49 per cent collectively to overall spend in e-tail segment.

- Apparel and footwear sale has almost doubled as compared to the previous year, recording a 52 per cent YOY growth from Rs 4699 crores in December 2014 to Rs 7142 crores in December 2015. This segment is expected to gain further momentum and reach Rs. 72639 crores by the end of 2016.

3Current Trends

Online shoppers are present (see below) both in the top eight metros and small metros. Around 29 per cent of these shoppers belong to small metros. A majority of these shoppers are from SEC B segments. They are equally spread among male and female shoppers.

Apparel is the top most categories that are searched by shoppers. 48 per cent of the shoppers have looked for information on apparels online of which 18 per cent indicated that they have done a purchase offline.

Footwear, Mobile and Accessories and Online tickets are other top products that are searched online and are mostly purchased from offline channels.

4E-commerce consumers in metro & non-metro cities

E-commerce giant Amazon India has stated in a recent report that more than half of its consumers come from the non-metro cities! Absence of good quality shopping malls and big brand’s outlet in these cities have driven the consumers to jump online for better options.

Research shows that, Indian digital shoppers mostly belong to top eight metro cities and small metros. Most of these shoppers fall in the age group 16 to 34 years. They are predominantly male (around 64 per cent), and belong to higher SEC groups – SEC A and SEC B.