With increasing smartphone penetration, non-bank institutions offering payment solutions, customers demanding instantaneous solutions and changes in the regulatory framework, the digital payments space in India is set to witness significant disruption in the days ahead, says a recent BCG-Google report titled Digital Payments 2020.

Read: Boom time for consumers as retailers, mobile wallets tie up

The report indicates that the total payments conducted via digital payment instruments will be in the range of US $500 billion by 2020, which is approximately 10x of current levels.

While the exact form and shape of disruption will only be unveiled over time, the reports brings out seven trends that are set to transform the payments landscape in India over the next five years. Here’s a look:

1Technology Will Make Digital Payment Simpler

Smartphone penetration, ubiquitous connectivity, biometrics, tokenisation, cloud computing and the Internet of Things are a few trends that will shape the way consumers transact in the future.

2Merchant Acceptance Network to Grow 10x by 2020

Mobile based payment solutions and proprietary payment networks will drive merchant acquisition by offering low-investment solutions that will make economics more attractive for merchants and acquirers, resulting in over 10 million merchant establishments that will accept digital /mobile payments.

3Payments Will Drive Consumption, Not The Other Way Around

Payments will provide access to customer transaction data, enabling payment service providers (PSPs) to offer relevant deals, offers and coupons to consumers, thereby influencing their consumption decisions.

4Consolidation Will Drive Ubiquity

Customers prefer fewer, ubiquitous payment solutions. Niche or limited use solutions will be forced to merge to offer near universal solutions.

5Modified UPI Will Be A Game Changer

Unified Payments Interface (UPI) provides a great platform for seamless interoperability of PSPs. Modified to overcome current challenges, it can drive large scale adoption of digital payments.

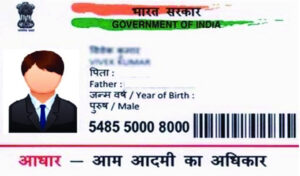

6Digital Identity To Accelerate Customer Acquisition

Using Aadhar for online authentication and confirmation of KYC data will boost growth of digital payment systems.

7Cash To Non-Cash Ratio Will Invert Over 10 Yrs

Digitisation of cash will accelerate over the next few years. Non-cash payment transactions, which today constitute 22 per cent of all consumer payments, will overtake cash transactions by 2023. Digital payments instruments will drive the growth in non-cash payments.